Consider a publicly held company whose products you are familiar with. Some examples might include: Access the

Question:

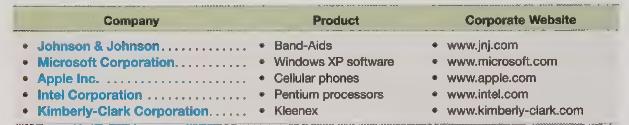

Consider a publicly held company whose products you are familiar with. Some examples might include:

Access the company’s public website and search for its most recent annual report. (Some companies provide access to their financial data through an “investor relations” link, while others provide a direct link to their “annual reports.”) After locating your company’s most recent annual report, open the file and review its contents.

After reviewing the annual report for your selected company, prepare answers to the following questions:

a. How many common shares are authorized, issued, and outstanding? What is the par (or stated) value of the common stock? What is the company’s market capitalization?

b. Does the company have any preferred stock issued and outstanding? If so, what is its par (or stated)

value and what is the amount of the annual dividend? Is the preferred stock callable, convertible, or participating?

c. Has the company repurchased any of its common shares in the last two years? If so, how much was spent on treasury stock in each of the last two years?

d. Does the company give stock options to its management team? If so, how many shares might be issued if all of the outstanding stock options are exercised? What would happen to the company’s earnings per share if the options are exercised?

e. Does the company pay dividends on its common stock? If so, what is the company’s dividend payout ratio? What is the company’s dividend yield? Is the company a “growth” company?

Step by Step Answer:

Financial Accounting For Executives And MBAs

ISBN: 9781618531988

4th Edition

Authors: Wallace, Simko, Ferris