Cummins reports the following information in the Management Discussion & Analysis section of its (200710-mathrm{K}) report. Financial

Question:

Cummins reports the following information in the Management Discussion \& Analysis section of its \(200710-\mathrm{K}\) report.

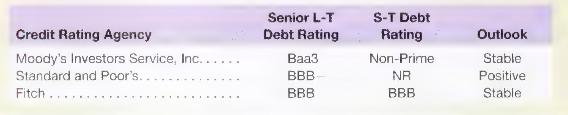

Financial Covenants and Credit Rating A number of our contractual obligations and financing agreements, such as our revolving credit facility and our equipment sale-leaseback agreements have restrictive covenants and/or pricing modifications that may be triggered in the event of downward revisions to our corporate credit rating. There have been no events in 2007 to impede our compliance with these covenants. On July 20, 2007, Fitch upgraded our senior unsecured debt ratings from "BBB-" to "BBB" and revised our outlook to stable citing the continued improvement in Cummins' balance sheet, increased sales diversification, an improved competitive profile and solid operating performance in North America in 2007 despite the downturn in the heavy truck cycle, among other factors. On August 16, 2007, Standard \& Poor's (S\&P) upgraded our outlook from stable to positive as S\&P cited Cummins' prospects for continued good operating performance and its improved financial profile resulting from a steady reduction in financial leverage over the last several years. Our current ratings and outlook from each of the credit rating agencies are shown in the table below.

a. Why does the reduction in financial leverage result in an increase in the credit ratings for Cummins' debt?

b. What effect will a higher credit rating have on Cummins' borrowing costs? Explain.

Step by Step Answer:

Financial Accounting For MBAs

ISBN: 9781934319345

4th Edition

Authors: Peter D. Easton, John J. Wild, Robert F. Halsey, Mary Lea McAnally