D. Roulstone opened Roulstone Roofing Service on April 1, 2010. Transactions for April follow section*{Required} a. Set

Question:

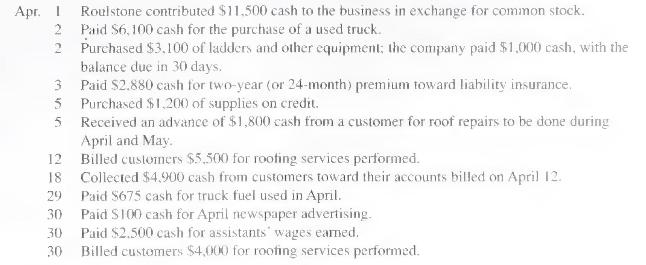

D. Roulstone opened Roulstone Roofing Service on April 1, 2010. Transactions for April follow

\section*{Required}

a. Set up T-accounts for the following accounts: Cash; Accounts Receivable: Supplies; Prepaid Insurance; Trucks; Accumulated Depreciation-Trucks; Equipment: Accumulated DepreciationEquipment; Accounts Payable: Unearned Roofing Fees; Common Stock; Roofing Fees Earned: Fuel Expense: Advertising Expense; Wages Expense; Insurance Expense; Supplies Expense: Depreciation Expense-Trucks; and Depreciation Expense-Equipment.

b. Record these transactions for April using journal entries.

c. Post these entries to their T-accounts (reference transactions in T-accounts by date).

d. Prepare an unadjusted trial balance at April 30, 2010.

e. Prepare entries to adjust the following accounts: Insurance Expense, Supplies Expense,

Depreciation Expense-Trucks, Depreciation Expense-Equipment, and Roofing Fees Earned in journal entry form. Supplies still available on April 30 amount to \(\$ 400\). Depreciation for April was \(\$ 125\) on the truck and \(\$ 35\) on equipment. One-fourth of the roofing fee received on April 5, was earned by April 30 .

f. Post adjusting entries to their T-accounts.

Step by Step Answer:

Financial Accounting For MBAs

ISBN: 9781934319345

4th Edition

Authors: Peter D. Easton, John J. Wild, Robert F. Halsey, Mary Lea McAnally