Following are forecasts of Abercrombie & Fitch's sales, net operating profit after tax (NOPAT), and net operating

Question:

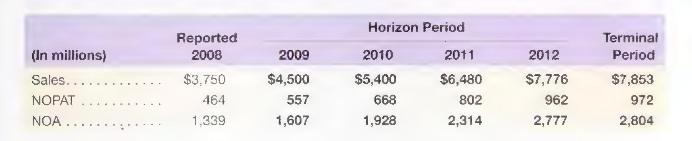

Following are forecasts of Abercrombie \& Fitch's sales, net operating profit after tax (NOPAT), and net operating assets (NOA) as of January 31, 2008.

Answer the following requirements assuming a discount rate (WACC) of \(13.3 \%\), a terminal period growth rate of \(1 \%\), common shares outstanding of 86.2 million, and net nonoperating obligations (NNO) of \(\$(279)\) million (negative NNO reflects net nonoperating assets such as investments rather than net obligations).

a. Estimate the value of a share of Abercrombie \& Fitch common stock using the discounted cash flow (DCF) model as of January 31, 2008.

b: Abercrombie \& Fitch (ANF) stock closed at \(\$ 77.56\) on March 2, 2008. How does your valuation estimate compare with this closing price? What do you believe are some reasons for the difference?

Step by Step Answer:

Financial Accounting For MBAs

ISBN: 9781934319345

4th Edition

Authors: Peter D. Easton, John J. Wild, Robert F. Halsey, Mary Lea McAnally