Following are selected disclosures from the (mathbb{R}) ohm and Haas Company (a specialty chemical company) (200710-mathrm{K}) The

Question:

Following are selected disclosures from the \(\mathbb{R}\) ohm and Haas Company (a specialty chemical company) \(200710-\mathrm{K}\)

The principal lives (in years) used in determining depreciation rates of various assets are: buildings and improvement (10-50); machinery and equipment (5-20); automobiles, trucks and tank cars (3-10); furniture and fixtures, laboratory equipment and other assets (5-10); capitalized software (5-7). The principal life used in determining the depreciation rate for leasehold improvements is the years remaining in the lease term or the useful life (in years) of the asset, whichever is shorter.

\section*{IMPAIRMENT OF LONG-LIVED ASSETS}

Long-lived assets, other than investments, goodwill and indefinite-lived intangible assets, are depreciated over their estimated useful lives, and are reviewed for impairment whenever changes in circumstances indicate the carrying value of the asset may not be recoverable. Such circumstances would include items such as a significant decrease in the market price of a longlived asset, a significant adverse change in the manner the asset is being used or planned to be used or in its physical condition or a history of operating or cash flow losses associated with the use of the asset... When such events or changes occur, we assess the recoverability of the asset by comparing the carrying value of the asset to the expected future cash flows associated with the asset's planned future use and eventual disposition of the asset, if applicable . . . We utilize marketplace assumptions to calculate the discounted cash flows used in determining the asset's fair value . . . For the year ended December 31, 2007, we recognized approximately \(\$ 24\) million of fixed asset impairment charges.

\section*{Required}

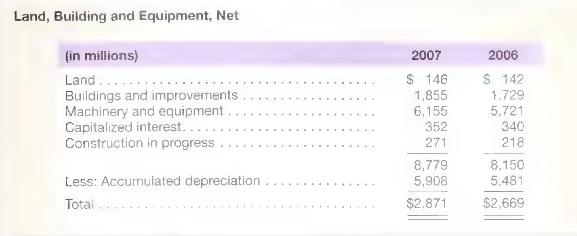

a. Compute the PPE (land, buildings and equipment) turnover for 2007 (Sales in 2007 are \(\$ 8,897\) million). Does the level of its PPE turnover suggest that Rohm and Haas is capital intensive? (Hint: The median PPE turnover for all publicly traded companies is approximately 5.03 in 2007.) Explain. Do you believe that Rohm and Haas' balance sheet reflects all of the company's operating assets? Explain.

b. Rohm and Haas reported depreciation expense of \(\$ 412\) million in 2007. Estimate the useful life, on average, for its depreciable PPE assets.

c. By what percentage are Rohm and Haas" assets "used up" at year-end 2007? What implication does the assets used up computation have for forecasting cash flows?

d. Rohm and Haas reports an asset impairment charge in 2007 . How do companies determine if assets are impaired? How do asset impairment charges affect Rohm and Haas' cash flows for 2007? How would we treat these charges for analysis purposes?

Step by Step Answer:

Financial Accounting For MBAs

ISBN: 9781934319345

4th Edition

Authors: Peter D. Easton, John J. Wild, Robert F. Halsey, Mary Lea McAnally