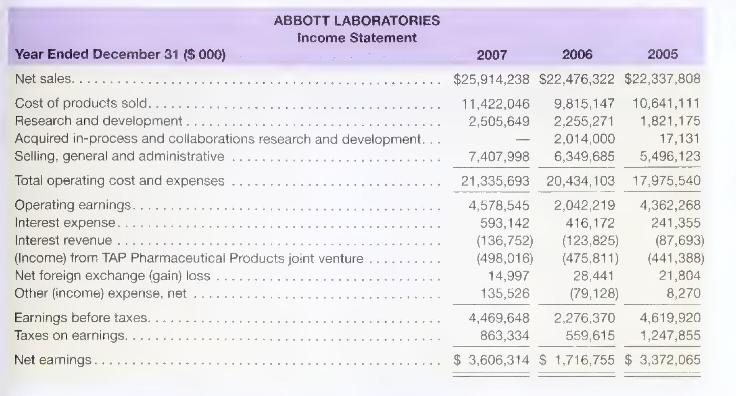

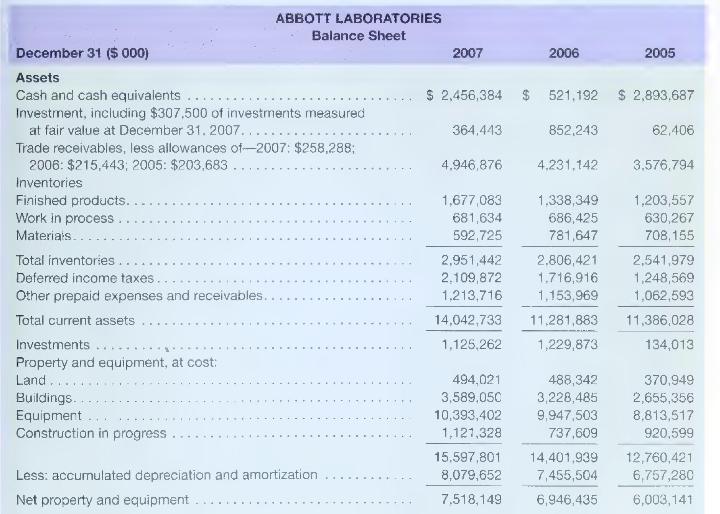

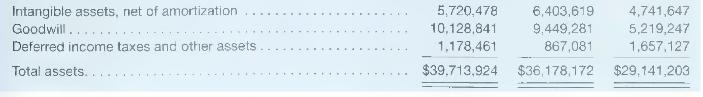

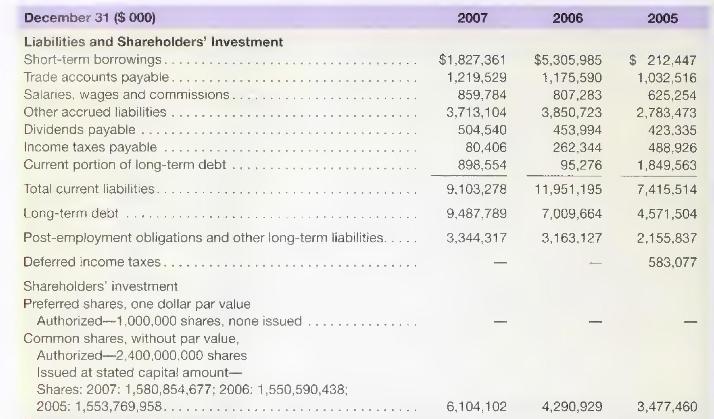

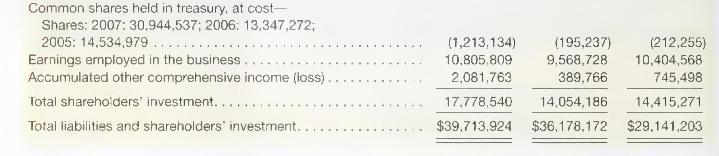

Following are the income statement and balance sheet for Abbott Laboratories (ABT). section*{Required} a. Compute net operating

Question:

Following are the income statement and balance sheet for Abbott Laboratories (ABT).

\section*{Required}

a. Compute net operating assets (NOA) for year end 2007.

b. Compute net operating profit after tax (NOPAT) for 2007 assuming a federal and state statutory tax rate of \(35.4 \%\)

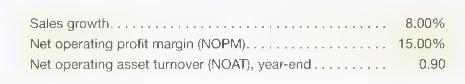

c. Forecast Abbott Laboratories' sales, NOPAT, and NOA for 2008 through 2011 using the following assumptions:

Forecast the terminal period value assuming a 1% terminal period growth and using the NOPM and NOAT assumptions above.

d. Estimate the value of a share of Abbott Laboratories' common stock using the discounted cash flow (DCF) model as of December 31, 2008; assume a discount rate (WACC) of 5%, common shares outstanding of 1,549.2 million, and net nonoperating obligations (NNO) of S11,228 million. Abbott Laboratories (ABT) stock closed at $56.18 on January 31, 2008. How does your valuation estimate compare with this closing price? What do you believe are some reasons for the difference? What investment position is suggested from your results? e.

Step by Step Answer:

Financial Accounting For MBAs

ISBN: 9781934319345

4th Edition

Authors: Peter D. Easton, John J. Wild, Robert F. Halsey, Mary Lea McAnally