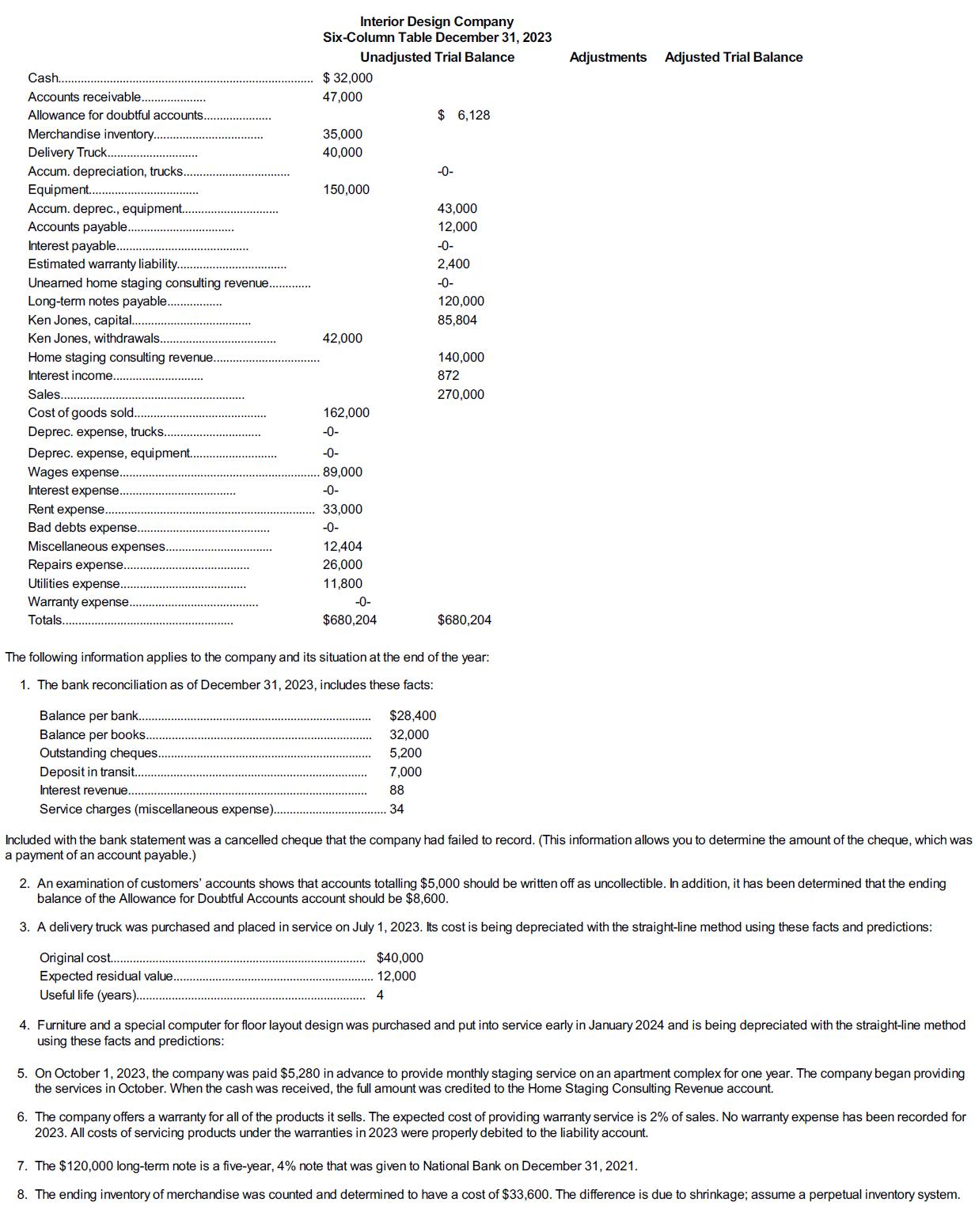

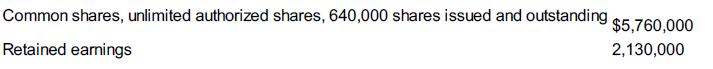

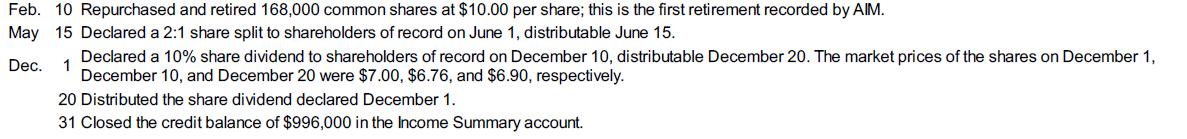

Fundamental Accounting Principles Volume 2 17th Canadian Edition Kermit D. Larson, Heidi Dieckmann, John Harris - Solutions

Unlock comprehensive insights with our exclusive resource for "Fundamental Accounting Principles Volume 2, 17th Canadian Edition" by Kermit D. Larson, Heidi Dieckmann, and John Harris. Delve into expertly crafted answers key, detailed solutions manual, and solutions available in PDF format. Benefit from solved problems and access a wealth of questions and answers. Our step-by-step answers ensure clarity and depth, ideal for students and instructors alike. Explore the test bank and chapter solutions tailored for thorough understanding. Download our instructor manual and textbook solutions for free, and elevate your learning experience today!

![]()

![]() New Semester Started

Get 50% OFF

Study Help!

--h --m --s

Claim Now

New Semester Started

Get 50% OFF

Study Help!

--h --m --s

Claim Now

![]()

![]()