After returning from vacation, the accountant of Online Hearing Inc. was dismayed to discover that the income

Question:

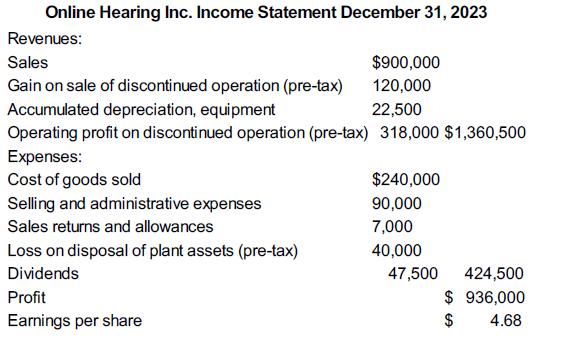

After returning from vacation, the accountant of Online Hearing Inc. was dismayed to discover that the income statement for the year ended December 31, 2023, was prepared incorrectly. All amounts included in the statement are before tax (assume a rate of 40%). The company had 200,000 common shares issued and outstanding throughout the year as well as 70,000 $1.00 cumulative preferred shares. Dividends had not been paid for the past two years (2021 and 2022). Retained earnings at December 31, 2022, were $171,000.

Required

Prepare a corrected income statement, using a multi-step format, including earnings per share information. Round all earnings per share calculations to the nearest whole cent.

Online Hearing Inc. Income Statement December 31, 2023 Revenues: Sales $900,000 Gain on sale of discontinued operation (pre-tax) 120,000 Accumulated depreciation, equipment 22,500 Operating profit on discontinued operation (pre-tax) 318,000 $1,360,500 Expenses: Cost of goods sold Selling and administrative expenses Sales returns and allowances Loss on disposal of plant assets (pre-tax) Dividends Profit Earnings per share $240,000 90,000 7,000 40,000 47,500 424,500 $ 936,000 $ 4.68

Step by Step Answer:

ONLINE HEARING INC Income Statement For Year Ended December 31 2023 Net sales Co...View the full answer

Fundamental Accounting Principles Volume 2

ISBN: 9781260881332

17th Canadian Edition

Authors: Kermit D. Larson, Heidi Dieckmann, John Harris

Students also viewed these Business questions

-

After returning from vacation, the accountant of Online Hearing Inc. was dismayed to discover that the income statement for the year ended December 31, 2014, was prepared incorrectly. All amounts...

-

After returning from vacation, the accountant of Online Hearing Inc. was dismayed to discover that the income statement for the year ended December 31, 2020, was prepared incorrectly. All amounts...

-

The income statement for Weatherford International Inc.s year ended December 31, 2014, was prepared by an inexperienced bookkeeper. As the new accountant, your immediate priority is to correct the...

-

Describe the three cases to consider when determining if a cost allocation is beneficial.

-

The following list includes activities that are performed in a physicians office. Classify each activity as value-added or non-value-added. For each non-value-added activity, state whether it can be...

-

In 2015, Simon, age 12, has interest income of $800 and dividend income of $4,000. He has no investment expenses. His parents have taxable income of $80,200 and file a joint tax return. Assume that...

-

Bananas are on sale at the Cross Towne store for 69 per pound. They normally sell for 99 per pound at your corner store. If round-trip bus fare costs $2.80 to the Cross Towne store, is it worth...

-

The firm for which you work estimates its short run revenue with R = 10e e2 where e is your work effort and R is the firms revenue. You choose your work effort on the short term basis to maximize...

-

Bruer Jeep Tours operates jeep tours in the heart of the Colorado Rockies. The company bases its budgets on two measures of activity (i.e., cost drivers), namely guests and jeeps. One vehicle used in...

-

Fitz Products Inc. reported $1,075,049 profit in 2023 and declared preferred dividends of $75,100. The following changes in common shares outstanding occurred during the year. Jan. 1 78,000 common...

-

How are earnings per share results calculated for a corporation with a simple capital structure?

-

The following additional information is available for the Albert and Allison Gaytor family. The Gaytors own a rental beach house in Hawaii. The beach house was rented for the full year during 2018...

-

Problem 1 PROBLEMS Sabres Limited, a Canadian-controlled private corporation whose fiscal year end is December 31, provides you with the following data concerning its tax accounts and capital...

-

9.6. A habitual gambler often visits three different casinos and plays roulette there. He wants to discover at which casino he has better luck with his roulette games. So, he records his gambling...

-

The firm has estimated that its sales for 2 0 1 3 will be $ 8 4 6 , 7 5 6 Cash dividends to be paid by the firm in 2 0 1 3 $ 3 7 , 7 2 0 Minimum cash balance to be maintained by the firm $ 2 8 , 5 1...

-

Bob Long was hired by County Hospital aS supervisor of engineering and maintenance. Although well experienced in his field, this was his first management job. Soon after Bob's arrival a maintenance...

-

Initial Outlay (IO) 1. A company is considering purchasing a machine for $100,000. Shipping costs would be another $5,000. The project would require an initial investment in net working capital of...

-

The next table reports annual U.S. school enrollment (in thousands) for the period 1990-2014. a. Use the 1990 to 2011 enrollments and simple exponential smoothing to forecast the 2012-2014 school...

-

Fill in each blank so that the resulting statement is true. 83 + 103 = ______ .

-

On March 1, 2017, JenStar Hydroponics Inc. issued at par an $80,000, 6%, three-year bond. Interest is to be paid quarterly beginning May 31, 2017. JenStars year-end is July 31. A partial payment...

-

Talent, a local HR consulting firm, has total partners equity of $760,000, which is made up of Hall, Capital, $600,000, and Reynolds, Capital, $160,000. The partners share profit/(losses) in a ratio...

-

On June 17, 2017, Bishop agrees to invest $30,000 into an online custom T-shirt print shop business for a 40% interest in total partnership equity. At the time Bishop is admitted, the existing...

-

Indicate whether the following managerial policy increases the risk of a death spiral:Use of low operating leverage for productionGroup of answer choicesTrueFalse

-

It is typically inappropriate to include the costs of excess capacity in product prices; instead, it should be written off directly to an expense account.Group of answer choicesTrueFalse

-

Firms can avoid the death spiral by excluding excess capacity from their activity bases. Group of answer choicesTrueFalse

Study smarter with the SolutionInn App