Question:

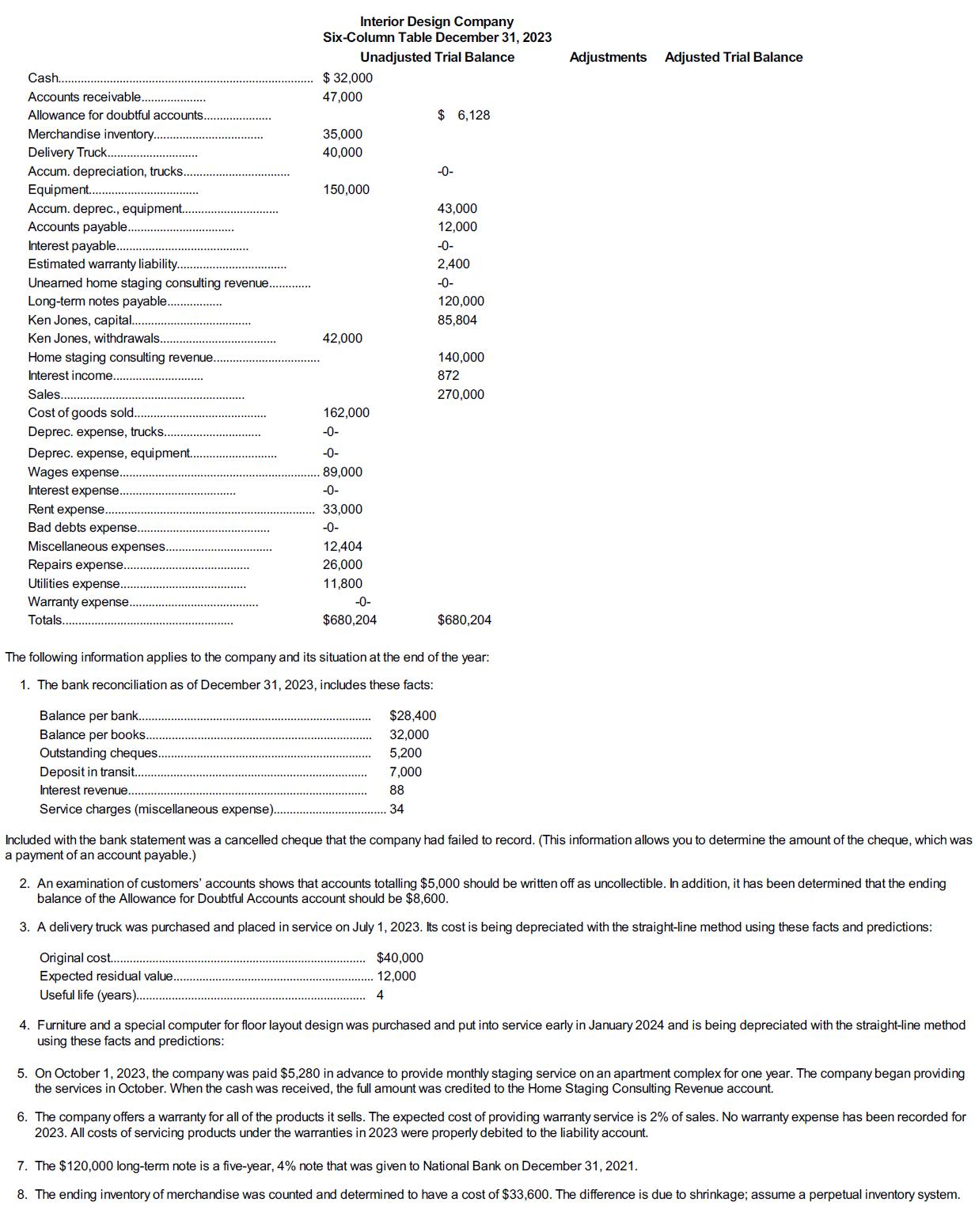

Interior Design Company specializes in home staging consulting services and sells furniture built by European craftsmen. The following six-column table contains the company’s unadjusted trial balance as of December 31, 2023.

Required

1. Use the preceding information to determine the amounts of the following items:

1. The correct ending balance of Cash and the amount of the omitted cheque.

2. The adjustment needed to obtain the correct ending balance of the Allowance for Doubtful Accounts.

3. The annual depreciation expense for the delivery truck that was acquired during the year (calculated to the nearest month).

4. The annual depreciation expense for the equipment that was in use during the year.

5. The correct ending balances of the Home Staging Consulting Revenue and Unearned Home Staging Consulting Revenue accounts.

6. The correct ending balances of the accounts for Warranty Expense and Estimated Warranty Liability.

7. The correct ending balance of the Interest Expense account. (Round amounts to the nearest whole dollar.)

8. The cost of goods sold for the year.

2. Use the results of requirement 1 to complete the six-column table by first entering the appropriate adjustments for items (a) through (h) and then completing the adjusted trial balance columns.

3. Present general journal entries to record the adjustments entered on the six-column table.

4. Present a single-step income statement, a statement of changes in equity, and a classified balance sheet.

Transcribed Image Text:

Cash..

Accounts receivable.

Allowance for doubtful accounts.

Merchandise inventory....

Delivery Truck..

Accum. depreciation, trucks.

Equipment.....

Accum. deprec., equipment.

Accounts payable..

Interest payable..

Estimated warranty liability..

Unearned home staging consulting revenue....

Long-term notes payable...

Ken Jones, capital........

Ken Jones, withdrawals....

Home staging consulting revenue.

Interest income..

Sales.

Cost of goods sold..

Deprec. expense, trucks..

Deprec. expense, equipment..

Wages expense..

Interest expense...

Rent expense......

Bad debts expense.

Miscellaneous expenses.

Repairs expense..

Utilities expense..

Warranty expense.

Totals.

Interior Design Company

Six-Column Table December 31, 2023

Unadjusted Trial Balance

Balance per bank..

Balance per books..

Outstanding cheques..

Deposit in transit....

Interest revenue..

Service charges (miscellaneous expense).

$32,000

47,000

35,000

40,000

150,000

42,000

162,000

-0-

-0-

89,000

-0-

33,000

-0-

12,404

26,000

11,800

-0-

$680,204

$ 6,128

$28,400

32,000

5,200

7,000

88

34

-0-

43,000

12,000

-0-

2,400

-0-

120,000

85,804

140,000

872

270,000

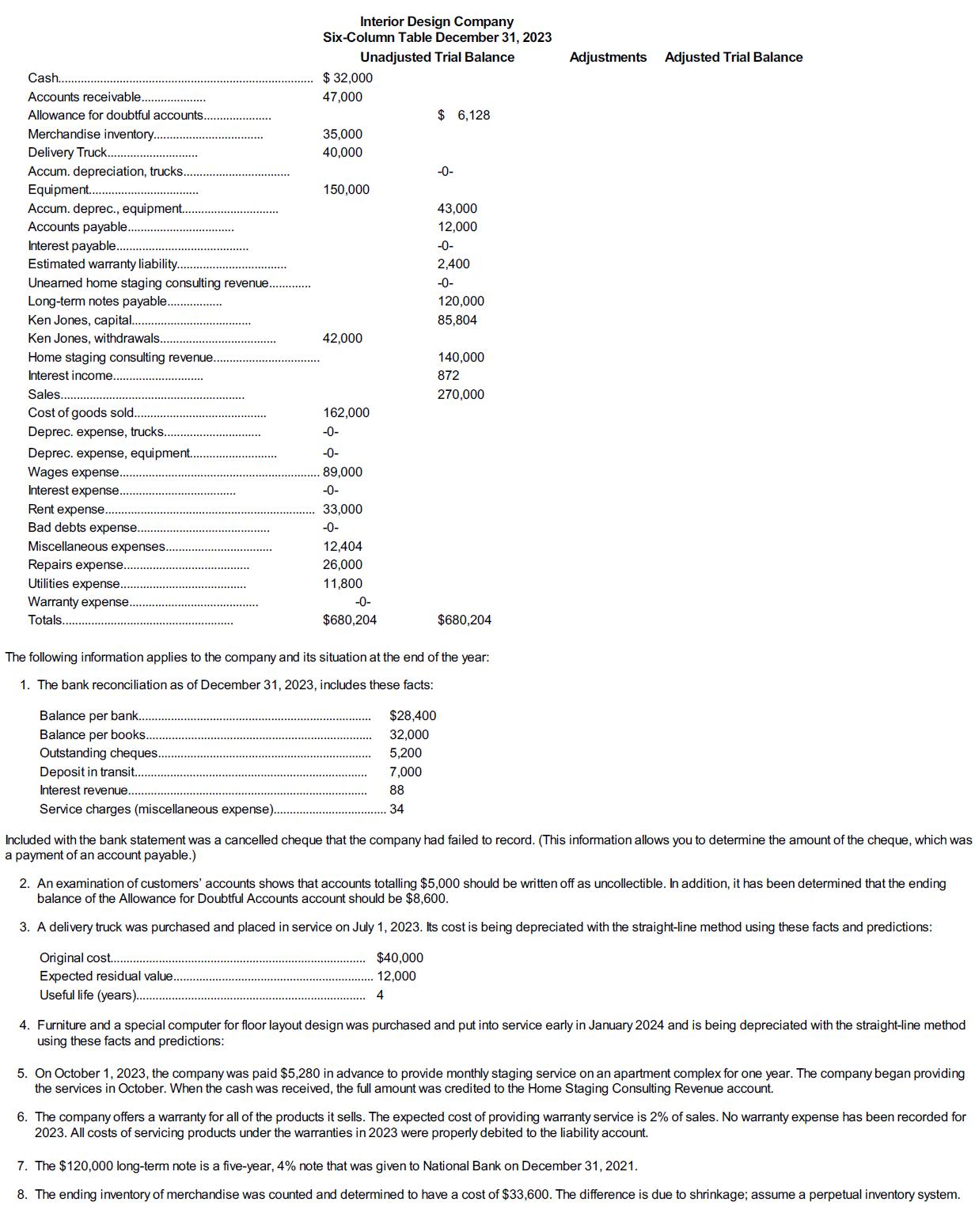

The following information applies to the company and its situation at the end of the year:

1. The bank reconciliation as of December 31, 2023, includes these facts:

$680,204

Adjustments Adjusted Trial Balance

Included with the bank statement was a cancelled cheque that the company had failed to record. (This information allows you to determine the amount of the cheque, which was

a payment of an account payable.)

2. An examination of customers' accounts shows that accounts totalling $5,000 should be written off as uncollectible. In addition, it has been determined that the ending

balance of the Allowance for Doubtful Accounts account should be $8,600.

3. A delivery truck was purchased and placed in service on July 1, 2023. Its cost is being depreciated with the straight-line method using these facts and predictions:

Original cost...

Expected residual value.

Useful life (years)...

$40,000

12,000

4

4. Furniture and a special computer for floor layout design was purchased and put into service early in January 2024 and is being depreciated with the straight-line method

using these facts and predictions:

5. On October 1, 2023, the company was paid $5,280 in advance to provide monthly staging service on an apartment complex for one year. The company began providing

the services in October. When the cash was received, the full amount was credited to the Home Staging Consulting Revenue account.

6. The company offers a warranty for all of the products it sells. The expected cost of providing warranty service is 2% of sales. No warranty expense has been recorded for

2023. All costs of servicing products under the warranties in 2023 were properly debited to the liability account.

7. The $120,000 long-term note is a five-year, 4% note that was given to National Bank on December 31, 2021.

8. The ending inventory of merchandise was counted and determined to have a cost of $33,600. The difference is due to shrinkage; assume a perpetual inventory system.