Spicer Inc. showed the following alphabetized list of adjusted account balances at December 31, 2023: Required Assuming

Question:

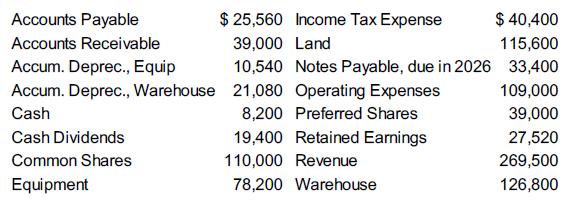

Spicer Inc. showed the following alphabetized list of adjusted account balances at December 31, 2023:

Required

Assuming normal balances, prepare the closing entries at December 31, 2023, the company’s year-end. Also, calculate the post-closing balance in Retained Earnings at December 31, 2023.

Transcribed Image Text:

Accounts Payable Accounts Receivable Accum. Deprec., Equip Accum. Deprec., Warehouse Cash Cash Dividends Common Shares Equipment $ 25,560 Income Tax Expense $ 40,400 115,600 39,000 Land 10,540 Notes Payable, due in 2026 33,400 21,080 Operating Expenses 109,000 8,200 Preferred Shares 39,000 27,520 269,500 126,800 19,400 Retained Earnings 110,000 Revenue 78,200 Warehouse

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (4 reviews)

2023 Dec 31 Revenue Income Summary To close the revenue account to the ...View the full answer

Answered By

Muhammad Umair

I have done job as Embedded System Engineer for just four months but after it i have decided to open my own lab and to work on projects that i can launch my own product in market. I work on different softwares like Proteus, Mikroc to program Embedded Systems. My basic work is on Embedded Systems. I have skills in Autocad, Proteus, C++, C programming and i love to share these skills to other to enhance my knowledge too.

3.50+

1+ Reviews

10+ Question Solved

Related Book For

Fundamental Accounting Principles Volume 2

ISBN: 9781260881332

17th Canadian Edition

Authors: Kermit D. Larson, Heidi Dieckmann, John Harris

Question Posted:

Students also viewed these Business questions

-

Read the article: The Effectiveness of Marketing Communication and Importance of Its Evaluation in an Online Environment by Anna Krizanova et al (2019) This article describes and measure the...

-

Spicer Inc. showed the following alphabetized list of adjusted account balances at December 31, 2020: Required Assuming normal balances, prepare the closing entries at December 31, 2020, the...

-

Xmet Inc. showed the following alphabetized list of adjusted account balances at December 31, 2014: Accounts Payable ........................ $ 25,760 Accounts Receivable.................... 39,200...

-

Window World extended credit to customer Nile Jenkins in the amount of $130,900 for his purchase of window treatments on April 2. Terms of the sale are 2/60, n/150. The cost of the purchase to Window...

-

TechGeek designs and produces high-tech gadgets that appeal to highly educated men between the ages of 25 and 50. These customers aren't as concerned about price as they are about innovation and...

-

Air at 30C flows at a uniform speed of 35.0 m/s along a smooth flat plate. Calculate the approximate x-location along the plate where the boundary layer begins the transition process toward...

-

2. The encumbrance account of a governmental unit is debited when: a The budget is recorded b A purchase order is approved c Goods are received d A voucher payable is recorded

-

Characterize the leadership style of Glen and the culture of the company.

-

Hills Company's June 30 bank statement and the June ledger account for cash are summarized here: Withdrawals Deposits $ 24,300 Balance, June 1 Deposits during June Cheques cleared during June Bank...

-

Arcus Development Inc.s equity section on the December 31, 2022, balance sheet showed the following information: On January 15, 2023, the companys board of directors declared a 15% share dividend to...

-

AIM Inc. showed the following equity account balances on the December 31, 2022, balance sheet: During 2023, the following selected transactions occurred: Required a. Journalize the transactions above...

-

Refer to the scenario in Problem 47 regarding the identification of churning cellphone customers. Apply k-nearest neighbors to classify observations as churning or not by using Churn as the target...

-

Your company has a Microsoft 365 E5 subscription. You need to review the Advanced Analysis tab on emails detected by Microsoft Defender for Office 365. What type of threat policy should you...

-

(a) The Bright company is evaluating a project which will cost Rs 1,00,000 and will have no salvage value at the end of its 5-year life. The project will save costs of Rs. 40,000 a year. The company...

-

Dispatcher Collins is retiring after 30 years on the job. If each of the 38 officers in the department contributes $9 for a retirement gift, what is the total amount that could be spent on this gift

-

XYZ CO Adjusted Trial Balance Debit Credit Cash Accounts receivable Office supplies Prepaid rent $ 40 850 1 490 1 530 4 000 Office equipment Accumulated Depreciation Accounts payable 7 000 $ 450 1...

-

What positive outcomes could result from implementing job enlargement, job rotation, and job enrichment in an organization with which you are familiar? What objections or obstacles might be...

-

Civilian employment is broadly classified by the federal government into two categories-agricultural and nonagricultural. Employment figures (in thousands of workers) for farm and nonfarm categories...

-

Could the owner of a business prepare a statement of financial position on 9 December or 23 June or today?

-

Bonnie and Clyde each own one-third of a fast-food restaurant, and their 13-year-old daughter owns all of the other shares. Both parents work full-time in the restaurant, but the daughter works...

-

Blue is the owner of all of the shares of an S corporation, and Blue is considering receiving a salary of $110,000 from the business. She will pay the 7.65% FICA taxes on the salary, and the S...

-

Bob Roman, the major owner of an S corporation, approaches you for some tax planning help. He would like to exchange some real estate in a like-kind transaction under 1031 for real estate that may...

-

C0 = 10.648148 b) ( 4 Marks ) As of now, Given the above conditions on the option, what is the intrinsic value of the call option? What is the time value of the call option?

-

interest revenue 19,500 retained earning,end 5,000 selling expenses 145,00 prepaid insurance 20,000 loss and disposal of a business (discountied),net 28,000 income from operation 140,000 unearned...

-

cost that do not extend the acid capacity or it's useful life, but merely maintained the assd, or restore it to working order are recorded as losses True or False

Study smarter with the SolutionInn App