Following are the income statement and relevant footnotes from the (10-mathrm{K}) of Intuil, Inc. section*{Required} a. Describe

Question:

Following are the income statement and relevant footnotes from the \(10-\mathrm{K}\) of Intuil, Inc.

\section*{Required}

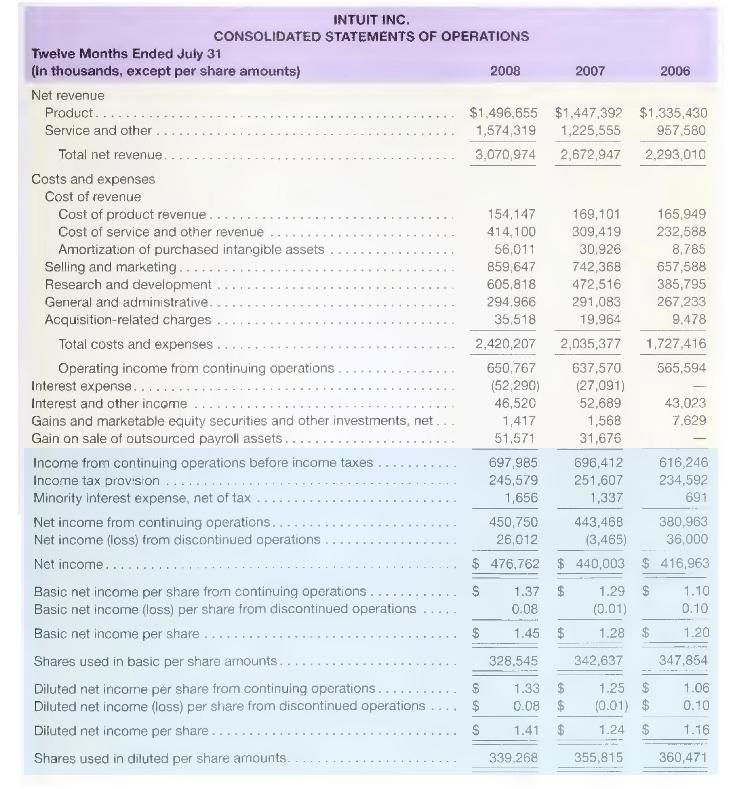

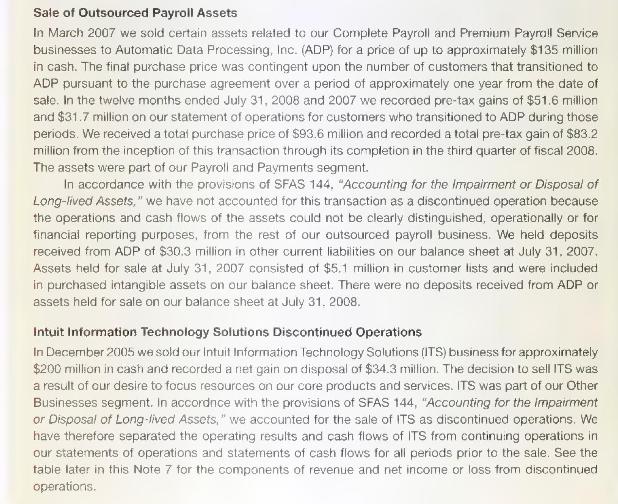

a. Describe the differences in revenue recognition between produce sales and after-sale services

b. Intuit reports \(\$ 605,818\) thousand of Research and Development expense, up from \(\$ 472,516\) thousand in the prior year.

i. What kind of research activities would we expect for a company like Intuit?

ii. Given the kind of research activities described in part i, how does the accounting for Inuit's R\&D costs differ from the way that those costs would have been accounted for had they not been categorized as \(\mathrm{R} \& \mathrm{D}\) ?

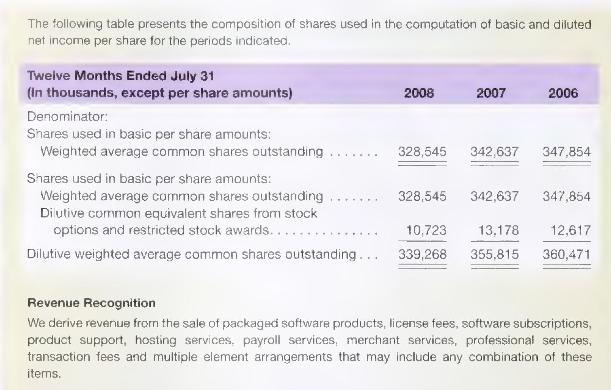

c. Intuit's earnings per share (EPS) is \(\$ 1.41\) on a diluted basis, compared with its basic EPS of \(\$ 1.45\). What factor \((\mathrm{s})\) accounts for this dilution?

d. Intuit accounts for the sale of its Information Technology Solutions segment as a discontinued operation but does not give that designation for its Sale of Outsourced Payroll Assets. Why is Intuit not treating the Sale of Outsourced Payroll Assets as a discontinued operation?

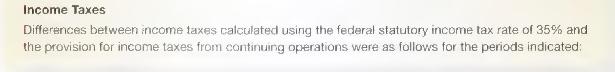

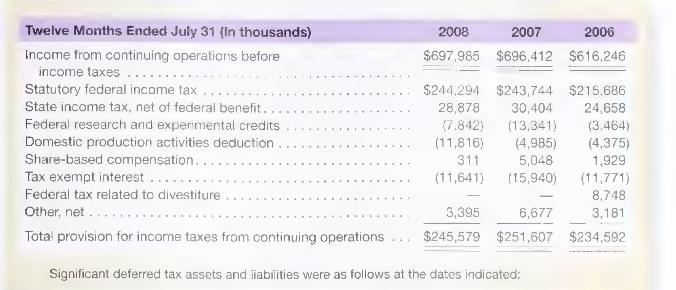

e. Drawing on Intuit's income tax footnote, prepare a table in percentages showing computation of its effective tax rate for each fiscal year 2008, 2007 and 2006. What tax-related items, if any. would we not expect to continue into fiscal year 2009?

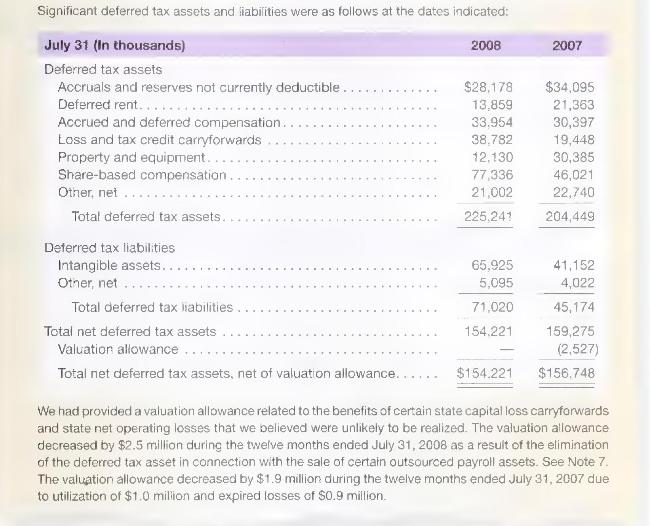

f. Intuit reports deferred tax assets of \(\$ 225,241\) thousand.

i. Describe how deferred tax assets relating to accruals and share-based compensation arise.

ii. Explain how deferred tax assets relating to loss carryforwards arise.

iii. Intuit reports a reduction of its deferred tax asset valuation allowance from \(\$ 2,527\) thousand in fiscal 2007 to \(\$ 0\) in fiscal 2008 . How does this reduction in its valuation allowance affect Intuit's income? (Hint: See its footnote for the deferred tax assets table.)

Step by Step Answer:

Financial Accounting For MBAs

ISBN: 9781934319345

4th Edition

Authors: Peter D. Easton, John J. Wild, Robert F. Halsey, Mary Lea McAnally