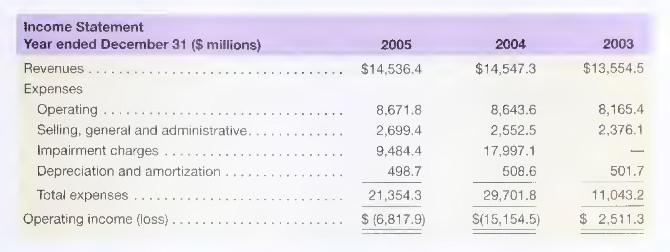

Following is the income statement of (1BS Corporation, along with an excerpt from its MD&A section. }

Question:

Following is the income statement of (1BS Corporation, along with an excerpt from its MD\&A section.

}

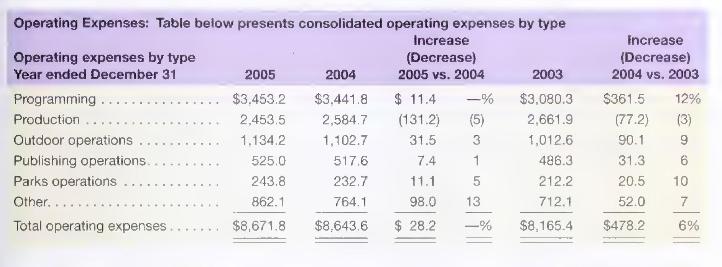

For 2005 , operating expenses of \(\$ 8.67\) billion increased slightly over \(\$ 8.64\) billion in 2004 . For 2004, operating expenses of \(\$ 8.64\) billion increased \(6 \%\) over \(\$ 8.17\) billion in 2003. The major components and changes in operating expenses were as follows:

- Programming expenses represented approximately \(40 \%\) of total operating expenses in 2005 and 2004 and \(38 \%\) in 2003 , and reflect the amortization of acquired rights of programs exhibited on the broadcast and cable networks, and television and radio stations. Programming expenses increased slightly to \(\$ 3.45\) billion in 2005 from \(\$ 3.44\) billion in 2004 principally reflecting higher costs for Showtime Networks theatrical titles. Programming expenses increased \(12 \%\) to \(\$ 3.44\) billion in 2004 from \(\$ 3.08\) billion in 2003 reflecting higher program rights expenses for sports events and primetime series at the broadcast networks.

- Production expenses represented approximately \(28 \%\) of total operating expenses in 2005 , \(30 \%\) in 2004 , and \(33 \%\) in 2003 , and reflect the cost and amortization of internally developed television programs, including direct production costs, residuals and participation expenses, and production overhead, as well as television and radio costs including on-air talent and other production costs. Production expenses decreased \(5 \%\) to \(\$ 2.45\) billion in 2005 from \(\$ 2.58\) billion in 2004 principally reflecting lower network costs due to the absence of Frasier partially offset by increased costs for new network series. Production expenses decreased \(3 \%\) to \(\$ 2.58\) billion in 2004 from \(\$ 2.66\) billion in 2003 reflecting fewer network series produced in 2004 partially offset by higher news costs for political campaign coverage.

- Outdoor operations costs represented approximately \(13 \%\) of total operating expenses in 2005 and 2004, and 12\% in 2003, and reflect transit and billboard lease, maintenance, posting and rotation expenses. Outdoor operations expenses increased \(3 \%\) to \(\$ 1.13\) billion in 2005 from \(\$ 1.10\) billion in 2004 principally reflecting higher billboard lease costs and maintenance costs associated with the impact of hurricanes in 2005 . Outdoor operations costs increased \(9 \%\) to \(\$ 1.10\) billion in 2004 from \(\$ 1.01\) billion in 2003 primarily reflecting higher transit and billboard lease costs.

- Publishing operations costs, which represented approximately \(6 \%\) of total operating expenses in each of the years 2005, 2004 and 2003, reflect cost of book sales, royalties and other costs incurred with respect to publishing operations. Publishing operations expenses for 2005 increased \(1 \%\) to \(\$ 525.0\) million and increased \(6 \%\) to \(\$ 517.6\) million in 2004 from \(\$ 486.3\) million in 2003 primarily due to higher revenues.

- Parks operations costs, which represented approximately \(3 \%\) of total operating expenses in each of the years 2005, 2004 and 2003, increased \(5 \%\) to \(\$ 243.8\) million in 2005 from \(\$ 232.7\) million in 2004 principally reflecting the cost of fourth quarter 2005 winter events held at the parks and the impact of foreign currency translation. In 2004, Parks operations costs increased \(10 \%\) to \(\$ 232.7\) million from \(\$ 212.2\) million in 2003 primarily from the impact of foreign currency translation.

- Other operating expenses, which represented approximately \(10 \%\) of total operating expenses in 2005 and 9\% in 2004 and 2003, primarily include distribution costs incurred with respect to television product, costs associated with digital media and compensation. Other operating expenses increased \(13 \%\) to \(\$ 862.1\) million in 2005 from \(\$ 764.1\) million in 2004 primarily reflecting a \(10 \%\) increase in distribution costs due to the DVD release of Charmed and increased costs associated with digital media from the inclusion of SportsLine.com, Inc. ("SportsLine.com") since its acquisition in December 2004. Other operating expenses for 2004 increased \(7 \%\) to \(\$ 764.1\) million in 2004 from \(\$ 712.1\) million in 2003 principally reflecting \(15 \%\) higher distribution costs due to additional volume of DVD releases of the Star Trek series and higher compensation.

Impairment Charges SFAS 142 requires the Company to perform an annual fair value-based impairment test of goodwill. The Company performed its annual impairment test as of October 31,2005 , concurrently with its annual budgeting process which begins in the fourth quarter each year. The first step of the test examines whether or not the book value of each of the Company's reporting units exceeds its fair value. If the book value for a reporting unit exceeds its fair value, the second step of the test is required to compare the implied fair value of that reporting unit's goodwill with the book value of the goodwill. The Company's reporting units are generally consistent with or one level below the operating segments underlying the reportable segments. As a result of the 2005 annual impairment test, the Company recorded an impairment charge of \(\$ 9.48\) billion in the fourth quarter of 2005 . The \(\$ 9.48\) billion reflects charges to reduce the carrying value of goodwill at the CBS Television reporting unit of \(\$ 6.44\) billion and the Radio reporting unit of \(\$ 3.05\) billion. As a result of the annual impairment test performed for 2004, the Company recorded an impairment charge of \(\$ 18.0\) billion in the fourth quarter of 2004. The \(\$ 18.0\) billion reflects charges to reduce the carrying value of goodwill at the Radio reporting unit of \(\$ 10.94\) billion and the Outdoor reporting unit of \(\$ 7.06\) billion as well as the reduction of the carrying value of intangible assets of \(\$ 27.8\) million related to the FCC licenses at the Radio segment. Several factors led to a reduction in forecasted cash flows and long-term growth rates for both the Radio and Outdoor reporting units. Radio and Outdoor both fell short of budgeted revenue and operating income growth targets in 2004. Competition from other advertising media, including Internet advertising and cable and broadcast television reduced Radio and Outdoor growth rates. Also, the emergence of new competitors and technologies necessitated a shift in management's strategy for the Radio and Outdoor businesses, including changes in composition of the sales force and operating management as well as increased levels of investment in marketing and promotion.

\section*{Required}

Identify and explain any income statement line items over the past three years that you believe should be considered for potential adjustment in preparation for forecasting the income statement of CBS.

Step by Step Answer:

Financial Accounting For MBAs

ISBN: 9781934319345

4th Edition

Authors: Peter D. Easton, John J. Wild, Robert F. Halsey, Mary Lea McAnally