Kraft Foods, Inc., reports the following footnote disclosure in its (200710-mathrm{K}) relating to its restructuring programs. section*{Asset

Question:

Kraft Foods, Inc., reports the following footnote disclosure in its \(200710-\mathrm{K}\) relating to its restructuring programs.

\section*{Asset Impairment, Exit and Implementation Costs}

\section*{Restructuring Program}

In January 2004, we announced a three-year restructuring program (the "Restructuring Program") and, in January 2006, extended it through 2008. The objectives of this program are to leverage our global scale, realign and lower our cost structure, and optimize capacity. As part of the Restructuring Program we anticipate:

- incurring approximately \(\$ 2.8\) billion in pre-tax charges reflecting asset disposals, severance and implementation costs;

- closing up to 35 facilities and eliminating approximately 13,500 positions; and - using cash to pay for approximately \(\$ 1.7\) billion of the \(\$ 2.8\) billion in charges.

We incurred charges under the Restructuring Program of \(\$ 459\) million in \(2007, \$ 673\) million in 2006 and \(\$ 297\) million in 2005. Since the inception of the Restructuring Program we have incurred \(\$ 2.1\) billion in charges and paid cash for \(\$ 1.1\) billion.

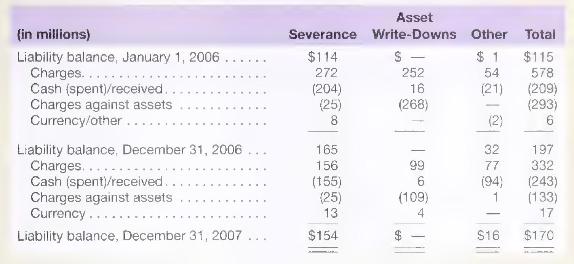

Restructuring liability activity for the years ended December 31, 2007 and 2006 was:

Severance costs include the costs of benefits received by terminated employees. In connection with our severance initiatives, we have eliminated approximately 11,000 positions as of December 31, 2007; at that time we had announced the elimination of an additional 400 positions. Severance charges against assets primarily relate to incremental pension costs, which reduce prepaid pension assets. Asset write-downs relate to the impairment of assets caused by plant closings and related activity. Cash received on asset write-downs relates to proceeds received from the sale of assets that had previously been written-off under the Restructuring Program. We incurred other costs related primarily to the renegotiation of supplier contract costs, workforce reductions associated with the plant closings and the termination of leasing agreements.

\section*{Asset Impairment Charges}

In 2007, we sold our flavored water and juice brand assets and related trademarks, including Veryfine and Fruit2O. In recognition of the sale, we recorded a \(\$ 120\) million asset impairment charge for these assets. The charge included the write-off of the associated goodwill of \(\$ 3\) million, intangible assets o \(\$ 70\) million and property, plant and equipment of \(\$ 47\) million, and was recorded as asset impairment and exit costs on the consolidated statement of earnings.

\section*{Required}

a. Briefly describe the general cost categories associated with this company's restructuring program.

b. Using the financial statement effects template, show the effects on financial statements of the ( 1 ) 2007 severance expense of \(\$ 156\) million, and (2) 2007 cash payment of \(\$ 155\) million.

c. Assume that instead of accurately estimating the anticipated severance costs in 2007 , the company overestimated them by \(\$ 30\) million. How would this overestimation affect financial statements in (1) 2007 , and (2) 2008 when severance costs are paid in cash?

d. Describe how the sale of its flavored water and juice brand assets affected Kraft's financial statements.

Step by Step Answer:

Financial Accounting For MBAs

ISBN: 9781934319345

4th Edition

Authors: Peter D. Easton, John J. Wild, Robert F. Halsey, Mary Lea McAnally