IFminmi, Inc. IC.II (>), reports total tax expense of ($ 5,065) (in thousands) on its income statement

Question:

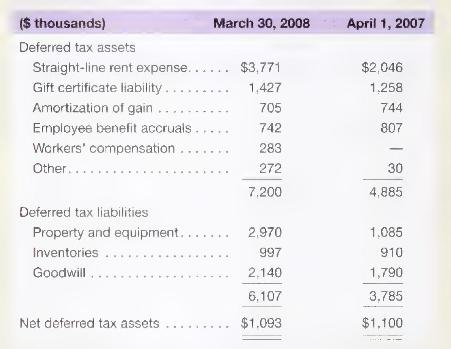

IFminmi, Inc. IC.II \(>\), reports total tax expense of \(\$ 5,065\) (in thousands) on its income statement for year ended March 30, 2008. The tax footnote in the company's \(10-\mathrm{K}\) filing, reports the following deferred tax information.

Income Taxes Deferred tax assets and liabilities reflect the tax effect of temporary differences between amounts of assets and liabilities for financial reporting purposes and the amounts of such assets and liabilities as measured by income tax law. A valuation allowance is recognized to reduce deferred tax assets to the amounts that are more likely than not to be realized. The income tax effects of temporary differences that give rise to deferred tax assets and liabilities are as follows (in thousands):

Accounting for Leases-Operating Leases Rent expense for the Company's operating leases, which generally have escalating rentals over the term of the lease, is recorded on a straight-line basis over the lease term. Generally, the lease term commences on the date when the Company becomes legally obligated for the rent payments or as specified in the lease agreement. Recognition of rent expense begins when the Company has the right to control the use of the leased property, which is typically before rent payments are due under the terms of most of the Company's leases. The difference between rent expense and rent paid is recorded as deferred rent obligation and is included in the consolidated balance sheets.

\section*{Required}

a. Did Benihana's deferred tax assets increase or decrease during the most recent fiscal year? Interpret the change. (Hint: Consider Benihana's accounting for leases.)

b. Did Benihana's deferred tax liabilities increase or decrease during the most recent fiscal year? Explain how the change arose.

c. Use the financial statement effects template to record Benihana's income tax expense for the fiscal year 2008 along with the changes in both deferred tax assets and liabilities. Assume that the amount needed to balance the tax transaction represents the cash paid or payable to tax authorities.

Step by Step Answer:

Financial Accounting For MBAs

ISBN: 9781934319345

4th Edition

Authors: Peter D. Easton, John J. Wild, Robert F. Halsey, Mary Lea McAnally