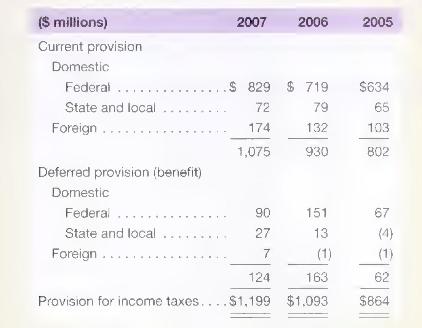

FedlEx reports the following footnote for income taxes in its (200710-mathrm{K}) report. The significant components of deferred

Question:

FedlEx reports the following footnote for income taxes in its \(200710-\mathrm{K}\) report.

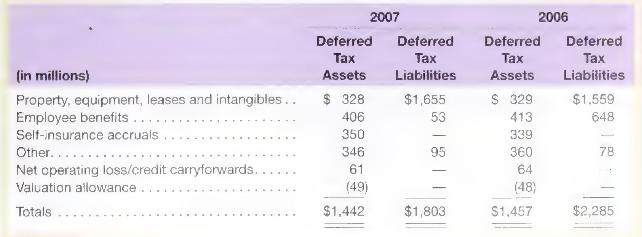

The significant components of deferred tax assets and liabilities as of May 31 were as follows.

\section*{Required}

a. What income tax expense does FedEx report in its 2007 income statement? How much of this expense is currently payable?

b. FedEx reports deferred tax liabilities relating to property, equipment. leases and intangibles Describe how these liabilities arise. How likely is it that these liabilities will be paid? Specifically.

describe a scenario that will (i) defer these taxes indefinitely, and (ii) will result in these liabilities requiring payment within the near future.

c. FedEx reports a deferred tax asset relating to self-insurance accruals. When a company selfinsures, it does not purchase insurance from a third-party insurance company. Instead, it records an expense and related liability to reflect the probable payment of losses that can occur in the future. Explain why this accrual results in a deferred tax asset.

d. FedEx reports net loss carryforwards. Explain how these arise and how they will result in a future benefit.

e. FedEx reports a valuation allowance related to its deferred tax assets. Why did FedEx set up such an allowance? How did the increase in the allowance from 2006 to 2007 affect net income? How can a company use this allowance to meet its income targets in a particular year?

Step by Step Answer:

Financial Accounting For MBAs

ISBN: 9781934319345

4th Edition

Authors: Peter D. Easton, John J. Wild, Robert F. Halsey, Mary Lea McAnally