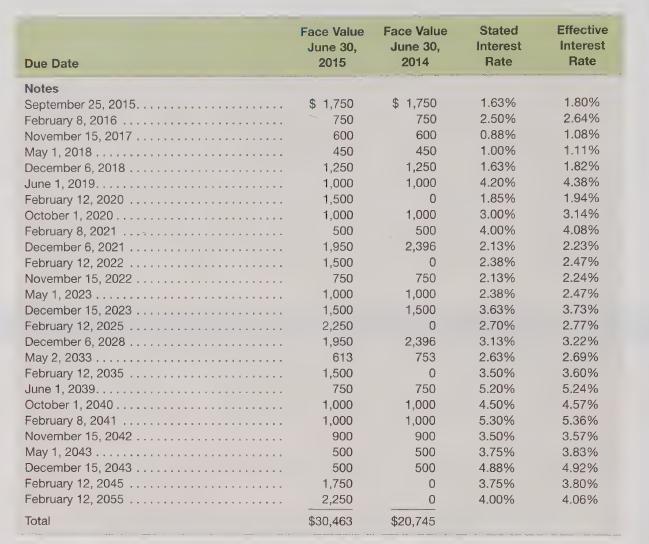

Microsoft Corporation reported the following information on its long-term debt in its 2015 annual report (in millions):

Question:

Microsoft Corporation reported the following information on its long-term debt in its 2015 annual report (in millions):

Required

1. Are the June 1, 2019 notes recorded at a discount or a premium? Why?

2. How much would the June 1, 2019 notes have been sold for if the market rate of interest at the time of sale had instead been six percent per year? Assume the notes originally had a 10-year (20 interest payment) term.

3. Assume Moody’s reports that the October 1, 2020 notes were rated as Aaa.

a. If the rating had been Aal instead, would the yield rate on the notes have been lower, higher, or the same?

b. If the notes had been secured, would the yield rate have been lower, higher, or the same?

4. Assume the company reported that the fair market value of the company’s October 1, 2040 notes was \($1,100\) million on June 30, 2015. Assume further that the recorded value of the notes was just slightly less than the \($1,000\) face value. If the company repurchased all of the notes on June 30, 2015, would a gain or loss have been recorded?

Step by Step Answer:

Financial Accounting For Executives And MBAs

ISBN: 9781618531988

4th Edition

Authors: Wallace, Simko, Ferris