Staples, Inc., reports the following footnote relating to its capital and operating leases in its (200710-mathrm{K} quad)

Question:

Staples, Inc., reports the following footnote relating to its capital and operating leases in its \(200710-\mathrm{K} \quad\) Staples, Inc. (SPLS) report ( \(\$\) thousands).

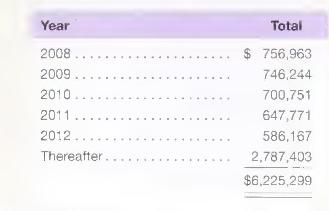

Future minimum lease commitments due for retail and support facilities (including lease commitments for 127 retail stores not yet opened at February 2, 2008) and equipment leases under non-cancelable operating leases are as follows (in thousands):

a. What dollar adjustment(s) might we consider to Staples' balance sheet and income statement given this information and assuming that Staples intermediate-term borrowing rate is \(8 \%\) ? Explain.

b. Would the adjustment from part a make a substantial difference to Staples ' total liabilities? (Staples reported total assets of \(\$ 9\) billion and total liabilities of \(\$ 3.3\) billion for 2008.)

Step by Step Answer:

Financial Accounting For MBAs

ISBN: 9781934319345

4th Edition

Authors: Peter D. Easton, John J. Wild, Robert F. Halsey, Mary Lea McAnally