YLM! Brands, Inc., reports the following footnote relating to its capital and operating leases in its 2007

Question:

YLM! Brands, Inc., reports the following footnote relating to its capital and operating leases in its 2007 10-K report ( \(\$\) millions).

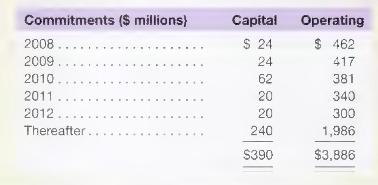

Future minimum commitments under non-cancelable leases are set forth below. At December 29, 2007, and December 30, 2006, the present value of minimum payments under capital leases was \(\$ 282\) million and \(\$ 228\) million, respectively.

a. Confirm that the implicit rate on YUM!'s capital leases is \(4.31 \%\). Using a \(4.31 \%\) discount rate, compute the present value of YUM!'s operating leases. Describe the adjustments we might consider to YUM!'s balance sheet and income statement using that information.

b. YUM! reported total liabilities of \(\$ 6,103\) million for 2007 . Would the adjustment from part \(a\) make a substantial difference to YUM!'s total liabilities? Explain.

Step by Step Answer:

Financial Accounting For MBAs

ISBN: 9781934319345

4th Edition

Authors: Peter D. Easton, John J. Wild, Robert F. Halsey, Mary Lea McAnally