The 2007 income statement for Ptizer is reproduced in this module. Pfizer also reports the following footnote

Question:

The 2007 income statement for Ptizer is reproduced in this module. Pfizer also reports the following footnote relating to its income taxes in its \(200710-\mathrm{K}\) report.

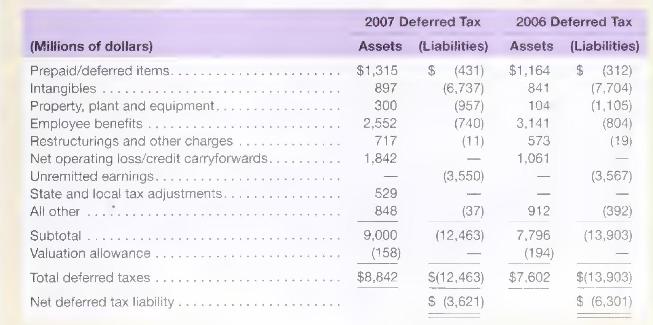

Deferred Taxes Deferred taxes arise because of different treatment between financial statement accounting and tax accounting, known as "temporary differences." We record the tax effect of these temporary differences as "deferred tax assets" (generally items that can be used as a tax deduction or credit in future periods) or "deferred tax liabilities" (generally items for which we received a tax deduction, but that have not yet been recorded in the consolidated statement of income). The tax effect of the major items recorded as deferred tax assets and liabilities . . . as of December 31 is as follows:

The reduction in the net deferred tax liability position in 2007 compared to 2006 is primarily due to amortization of deferred tax liabilities related to identifiable intangibles in connection with our acquisition of Pharmacia in 2003, partially offset by an increase in noncurrent deferred tax assets related to the impairment of Exubera.

We have carryforwards primarily related to foreign tax credit carryovers and net operating losses, which are available to reduce future U.S. federal and state, as well as international income with either an indefinite life or expiring at various times between 2008 and 2026 . Certain of our U.S. net operating losses are subject to limitations under Internal Revenue Code Section 382 .

Valuation allowances are provided when we believe that our deferred tax assets are not recoverable, based on an assessment of estimated future taxable income that incorporates ongoing, prudent, feasible tax planning strategies.

\section*{Required}

a. Describe the terms "deferred tax liabilities" and "deferred tax assets." Provide an example of how these accounts can arise

b. Intangible assets (other than goodwill) acquired in the purchase of a company are depreciated (amortized) similar to buildings and equipment (see Module 7 for a discussion). Describe how the deferred tax liability of \(\$ 6,737\) million relating to intangibles arose.

c. Pfizer has many employee benefit plans, such as a long-term health plan and a pension plan. Some of these are generating deferred tax assets and others are generating deferred tax liabilities. Explain the timing of the recognition of expenses under these plans that would give rise to these different outcomes.

d. Pfizer reports a deferred tax liability labelled "unremitted earnings." This relates to an investment in an affiliated company for which Pfizer is recording income, but has not yet received dividends. Generally, investment income is taxed when received. Explain what information the deferred tax liability for unremitted earnings conveys.

e. Pfizer reports a deferred tax asset relating to net operating loss carryforwards. Explain what loss carryforwards are.

f. Pfizer reports a valuation allowance of \(\$ 158\) million in 2007. Explain why Pfizer has established this allowance and its effect on reported profit. Pfizer's valuation allowance was \(\$ 194\) million in 2006. Compute the change in its allowance during 2007 and explain how that change affected 2007 tax expense and net income..

Step by Step Answer:

Financial Accounting For MBAs

ISBN: 9781934319345

4th Edition

Authors: Peter D. Easton, John J. Wild, Robert F. Halsey, Mary Lea McAnally