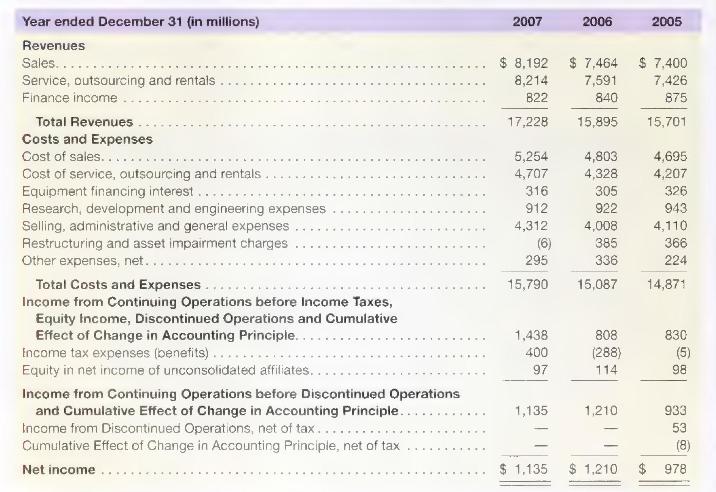

The income statement for Xerox Corporation follows section*{Required} a. Xerox reports three main sources of income: sales,

Question:

The income statement for Xerox Corporation follows

\section*{Required}

a. Xerox reports three main sources of income: sales, service, and finance income. How should revenue be recognized for each of these business activities? Explain.

b. Xerox reports research and development (R\&D) expenses of \(\$ 912\) million in 2007 , which is \(5.3 \%\) of its total revenues. How are \(R \& D\) expenses accounted for under GAAP?

c. Xerox reports restructuring costs of \(\$(6)\) million in 2007 , \(\$ 385\) million in 2006, and \(\$ 366\) million in 2006. (1) Describe the three typical categories of restructuring costs and the accounting for each. (2) How do you recommend treating these costs for analysis purposes? (3) Should regular recurring restructuring costs be treated differently than isolated occurrences of such costs for analysis purposes? (4) What does the \(\$(6)\) expense in 2007 imply about one or more previous year's accruals?

d. Xerox's tax expense was reduced as a result of a \(\$ 343\) million favorable IRS ruling in 2005 . How should this benefit be treated in your analysis of the company?

e. Xerox reports \(\$ 295\) million in expenses in 2007 labeled as 'Other expenses, net.' How can a company use such an account to potentially obscure its actual financial performance?

Step by Step Answer:

Financial Accounting For MBAs

ISBN: 9781934319345

4th Edition

Authors: Peter D. Easton, John J. Wild, Robert F. Halsey, Mary Lea McAnally