The Canik Corporation is a small manufacturer of photography products. Until recently, the company was all equity-financed

Question:

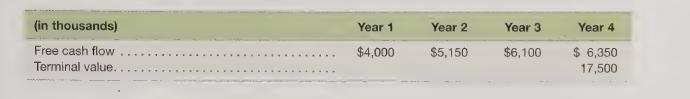

The Canik Corporation is a small manufacturer of photography products. Until recently, the company was all equity-financed (shareholders’ equity totaled \($13\) million), having a cost of equity of ten percent. The company decided to expand its productive capacity by investing in new plant and equipment at a cost of \($15\) million. Executives at Canik decided to finance the capital investment with lower-costing debt financing that carried an interest rate of only eight percent. The CEO of The Canik Corporation wondered what the company was now worth following the plant expansion; consequently, the CEO instructed the company’s CFO to prepare a forecast of the firm’s free cash flows. The CFO’s forecast was as follows:

Required

1. Calculate the value of the Canik Corporation.

2. Is the company’s decision to invest in new plant and equipment a good operating decision? Why?

Step by Step Answer:

Financial Accounting For Executives And MBAs

ISBN: 9781618531988

4th Edition

Authors: Wallace, Simko, Ferris