The venture capital division of a major U.S. financial institution has elected to fund an investment in

Question:

The venture capital division of a major U.S. financial institution has elected to fund an investment in an oil and gas exploration and production company that will operate both onshore and offshore in Texas and Louisiana in the United States. The initial financing commitment from the bank is for \($40\) million.

The company’s strategic plan calls for an aggressive drilling program to be carried out during 2012. Hofstedt Oil & Gas estimates that it will drill 50 wells at an average cost of \($800,000\) per well and that 30 of those wells will yield aggregate crude oil reserves of approximately 10 million barrels. The remaining 20 wells are expected to be dry or commercially unproductive. These forecasts were based on the expert opinion of geologists familiar with the properties and were confirmed by petroleum engineers employed directly by the bank.

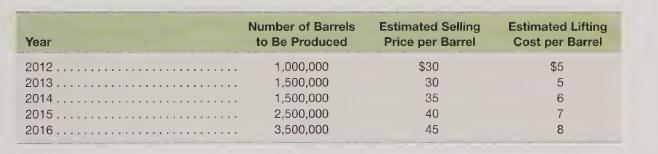

The company’s production plan calls for a maximum exploration effort to earn the highest financial return. Tom Hofstedt, president of the company, developed the following production scenario:

Hofstedt Oil & Gas is concerned about the impact of this operation on its financial statements and on the company’s stock price. Consequently, any available accounting policy choices loom as very important in the overall evaluation of the investment. As a result, Hofstedt sent a terse memo to the company’s controller, the closing line of which stated, “Prepare pro forma statements showing the alternative accounting effects on cash flow, income before tax, and financial position if we elect to use the successful efforts method or the full-cost method.” Under the full-cost method, the cost of all wells—successful and unsuccessful—are capitalized to the balance sheet and then depleted over the expected productive life of the successful wells. Under the successful efforts method, only the cost of the successful wells are capitalized (the cost of any unsuccessful wells are immediately expensed) to be depleted over their expected productive life.

Required For purposes of pro forma statement preparation, assume that the \($40\) million loan agreement will be repaid as follows: (1) \($10\) million principal repayment per year to be paid on December 31 beginning on December 31, 2013; and (2) interest payments of 10 percent per year on the balance of the loan outstanding as of the beginning of the year. Ignore income taxes and all other operations. Based on your pro forma cash flows, income statements, and balance sheets for the period 2012 through 2016, what accounting method (successful efforts or full cost) recommendation would you make to Hofstedt, and why?

Step by Step Answer:

Financial Accounting For Executives And MBAs

ISBN: 9781618531988

4th Edition

Authors: Wallace, Simko, Ferris