The Claremont Company is planning an initial public offering (IPO) and management would like to have an

Question:

The Claremont Company is planning an initial public offering (IPO) and management would like to have an idea of an appropriate price to charge for a share of its stock.

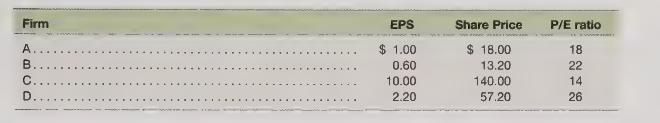

The company plans to issue 100,000 shares. The Claremont Company’s most recent earnings per share (EPS) are \($1.25;\) however, the consensus forecast among analysts who follow the company is for EPS to be \($1.50.\) The EPS and share price of four comparable firms are shown below:

Compute the value of a share of Claremont Company stock using the price-earnings multiples method.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Financial Accounting For Executives And MBAs

ISBN: 9781618531988

4th Edition

Authors: Wallace, Simko, Ferris

Question Posted: