Weis Markets, Inc., is a Pennsylvania business founded by Harry and Sigmund Weis in 1912. The company

Question:

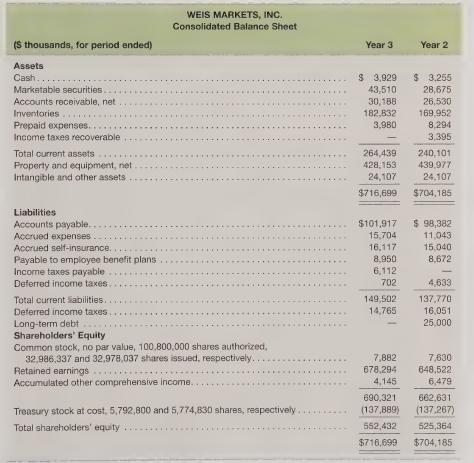

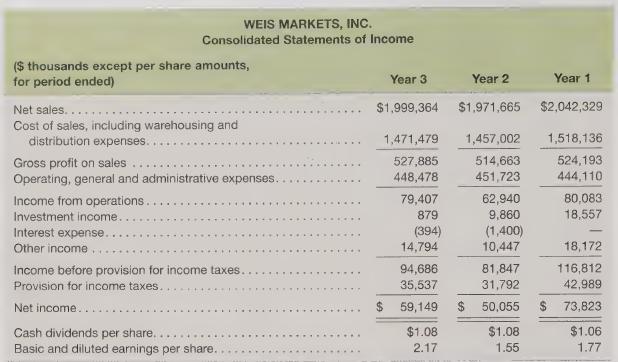

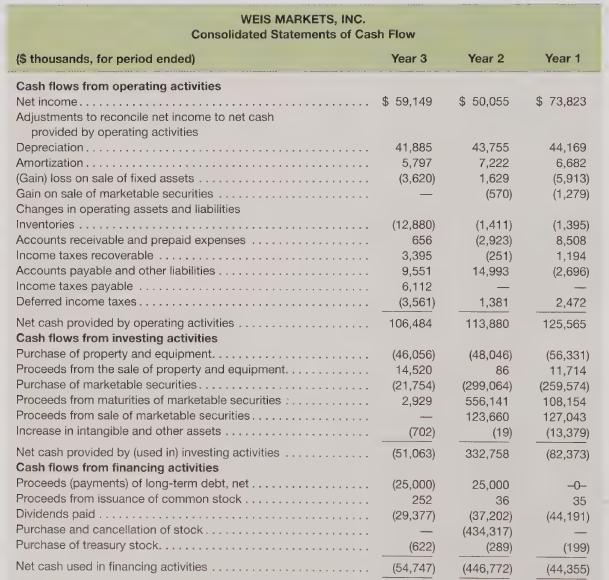

Weis Markets, Inc., is a Pennsylvania business founded by Harry and Sigmund Weis in 1912. The company is engaged principally in the retail sale of food and pet supplies in Pennsylvania and surrounding states. The Weis family currently owns approximately 62 percent of the outstanding shares. The company’s retail food stores sell groceries, dairy products, frozen foods, meats, seafood, fresh produce, floral, prescriptions, deli/bakery products, prepared foods, fuel and general merchandise items, such as health and beauty care and household products.

Required

1. Was Year 3 a good year or a bad year for Weis? Why?

2. What was the company’s interest coverage ratio in Year 3 and Year 2? On July 1, Year 3, Weis considered borrowing \($100\) million of long-term debt at an interest rate of ten percent per year to finance a \($100\) million investment in additional stores. The new properties would not generate earnings until Year 4. What would the company’s interest coverage ratio have been for Year 3 if it had completed the borrowing?

3. Evaluate Weis’s profitability in Year 2 and Year 3 using the ROE Model.

4. On March 31, following Year 3, Weis’s share price closed at \($29.85\) per share. Value Line forecasted sales of \($2,050\) million and \($2,125\) million and EPS of \($2.00\) and \($2.10\) per share for fiscal Year 4 and Year 5, respectively. The company’s cost of equity is approximately nine percent. Using the Residual Income valuation model, calculate the equity value of the company. [As a base case, a company whose expected ROE is twelve percent (14 percent) per year, whose cost of equity is nine percent, and whose growth in book value is expected to be four percent per year for the first ten years and three percent per year thereafter, would have an intrinsic value of 1.54 (1.90) times current book value.] Do you think Weis is worth \($29.85\) per share? Why?

Step by Step Answer:

Financial Accounting For Executives And MBAs

ISBN: 9781618531988

4th Edition

Authors: Wallace, Simko, Ferris