CSK Auto Corp. is the largest retailer of automotive parts and accessories in the Western United States

Question:

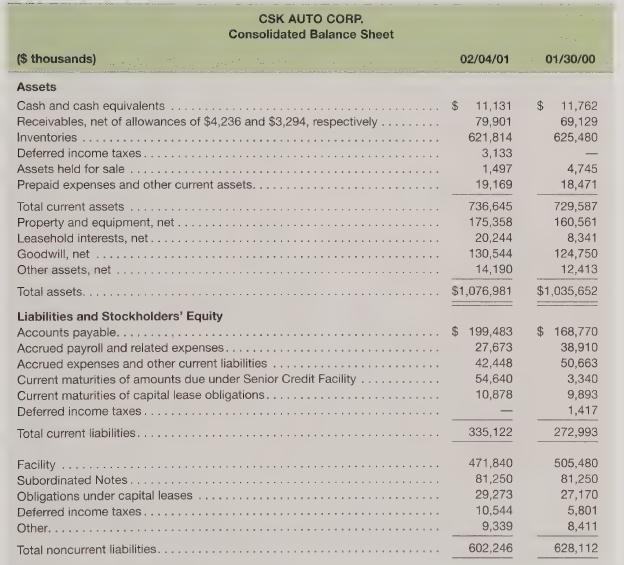

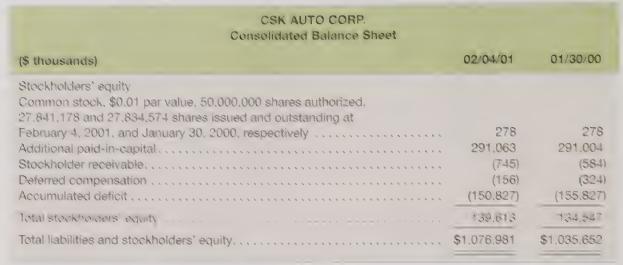

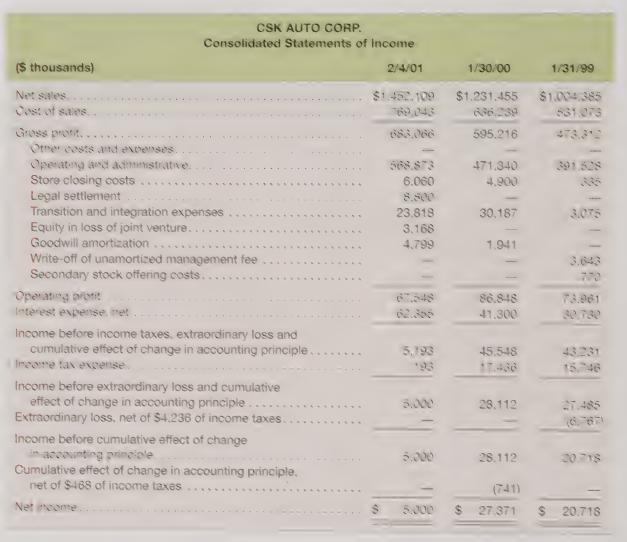

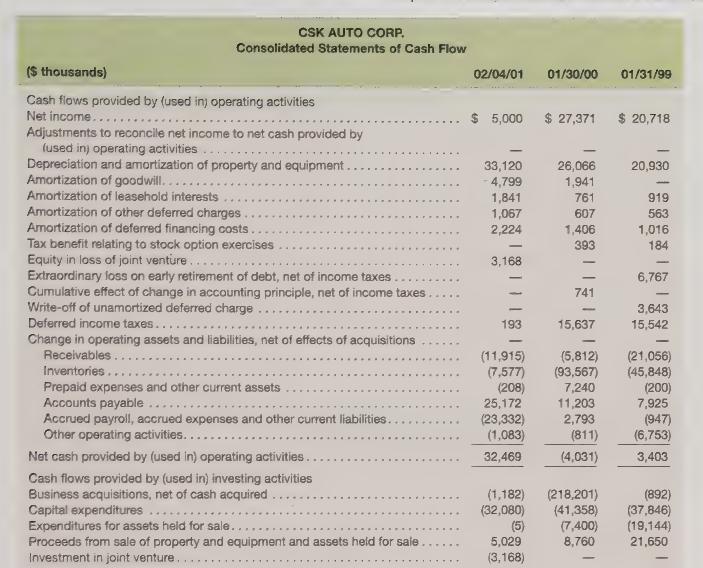

CSK Auto Corp. is the largest retailer of automotive parts and accessories in the Western United States and one of the largest retailers of such products in the United States based on the number of stores. As of February 4, 2001, the company operated 1,152 stores as one fully integrated company under three brand names: Checker Auto Parts, Schuck’s Auto Supply, and Kragen Auto Parts. Presented below is selected information from CSK Auto Corp.’s 2001 10-K report. Assume an effective tax rate of 40 percent.

Required

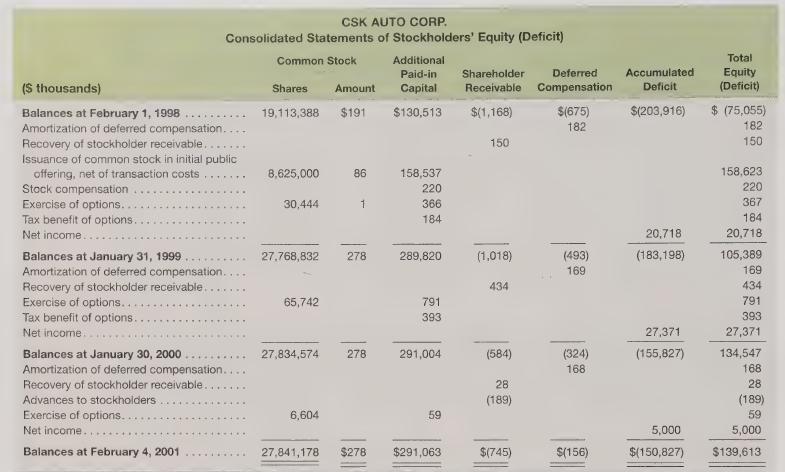

1. On March 17, 1998, the Company completed an initial public offering (IPO). What was the average price (net of underwriting fees) that CSK sold its shares for? :

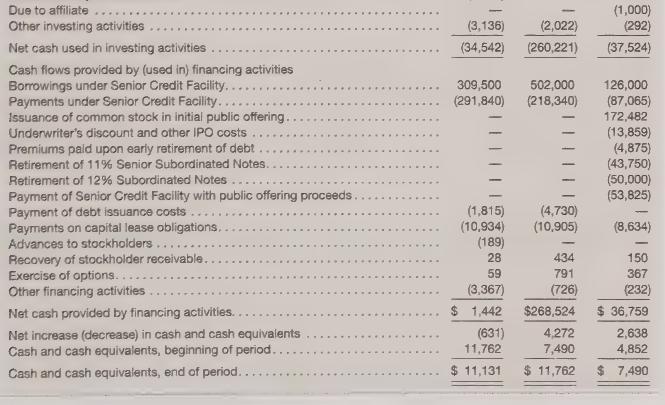

2. In 1999, CSK Auto spent \($260.221\) million on investing activities. How did the company finance this investment?

3. On February 4, 2001, the company’s share price was \($6.10\) per share. The Board of Directors believes that the company’s share price is too low and has recommended a share buyback program. What would be the financial effect of a share buyback, and what accounts would be affected if the company repurchased ten percent of its outstanding shares?

4. On March 1, 2000, the company participated in the formation of a new joint venture, PartsAmerica.com (PA) by acquiring 37 percent of the outstanding equity of PA. The company accounted for its investment in PA under the equity method.

a. What financial effects did the company record to reflect its investment in PartsAmerica on its financial statements?

b. During fiscal 2000, the company recognized its proportionate share of PA’s net loss and wrote off the remaining investment in the joint venture. What did the company record to reflect these events in its financial statements?

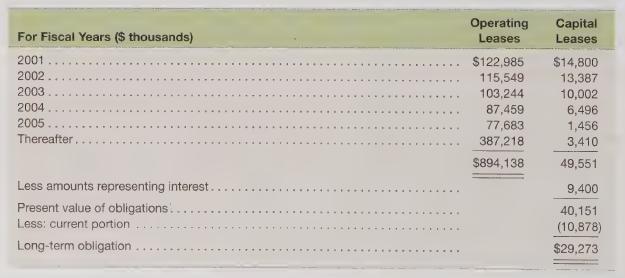

5. CSK Auto reports that included in property and equipment (net) are assets under capital leases (net of accumulated depreciation) of \($38.067\) million and \($35.676\) million on February 4, 2001 and January 30, 2000, respectively. Consider the information on leases provided in the financial statements and footnotes.

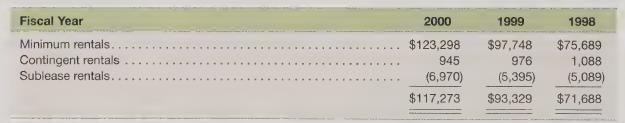

a. What cash payment is CSK Auto expecting to make for operating leases for the year ending February 4, 2002?

b. What financial effects will CSK Auto record for its capital leases for the year ending February 4, 2002?

6. CSK Auto recognizes income taxes based on pretax income.

a. What financial effects did CSK record to recognize income taxes in 2000?

b. Has CSK Auto reported more or less income to its shareholders cumulatively through February 4, 2001, than to the tax authorities? How much more or less?

7. On February 4, 2001, CSK Auto’s share price closed at \($6.10\) per share. Using the residual income valuation model, calculate the equity value of the company. Assume that the company’s cost of equity is approximately 10.4 percent. Top management thinks the share price should be considerably higher. How would you explain the situation to management?

Note 8: The Company leases its office and warehouse facilities, all but three of its retail stores, and a majority of its equipment. Generally, store leases provide for minimum rentals and the payment of utilities, maintenance, insurance and taxes. Certain store leases also provide for contingent rentals based upon a percentage of sales in excess of a stipulated minimum. The majority of lease agreements are for base lease periods ranging from 15 to 20 years, with three to five renewal options of five years each.

Operating lease rental expense is as follows (in thousands):

Future minimum lease obligations under noncancelable leases at February 4, 2001, follows:

Step by Step Answer:

Financial Accounting For Executives And MBAs

ISBN: 9781618531988

4th Edition

Authors: Wallace, Simko, Ferris