The Kat Company began operations in 2015. The year went very well with the company generating a

Question:

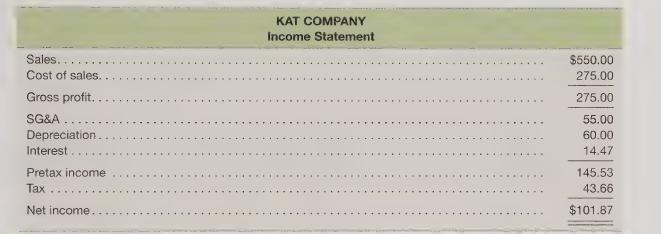

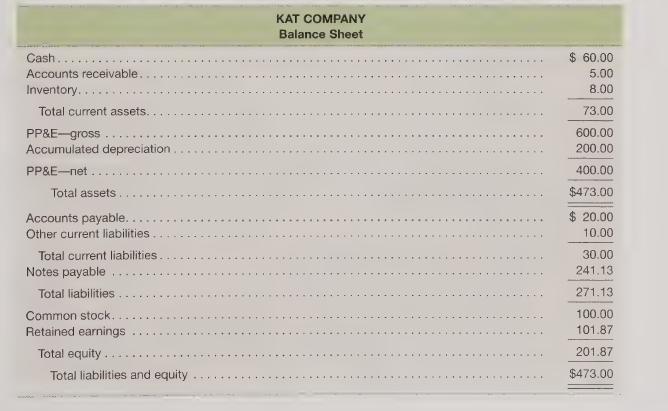

The Kat Company began operations in 2015. The year went very well with the company generating a positive net income, with strong demand for its products providing management with a rosy forecast for the future. Management is contemplating possibly going public and would like a valuation of the company. Below are the balance sheet and the income statement for the first year of operation, along with assumptions needed to calculate pro forma statements for the period 2016 through 2020, along with a terminal year projection.

Assumptions:

1. Sales will be \($975\) in 2016 then grow by 15 percent in 2017, ten percent in 2018, ten percent in 2019, and six percent in 2020. Terminal growth is assumed to be 5 percent.

2. Gross profit is assumed to be 60 percent in each year.

3. Sales, general, and administrative expenses are assumed to be 35 percent of sales in each year.

4. Depreciation is assumed to be ten percent of end of year gross PP&E, and then grow at a 5 percent rate in the terminal year.

5. Interest is assumed to be six percent of end of the year notes payable and then grow at a 5 percent rate in the terminal year.

6. Taxes are assumed to be 30 percent of pretax income.

7. The cash balance is projected to be 9.5 percent of sales.

8. The accounts receivable turnover is assumed to be 8.

9. The inventory turnover is assumed to be 5.

10. Gross PP&E is assumed to be \($850\) in 2016 and 2017, \($925\) in 2018, and then growing by \($25\) in each year of 2019 and 2020, and finally growing by 5 percent in the terminal year.

11. Accumulated depreciation is assumed to grow by the amount of yearly depreciation expense and then grow by 5 percent in the terminal year.

12. Accounts payable turnover is assumed to be 9.

13. Other current liabilities are assumed to be a constant \($20\) and then grow at a 5 percent rate in the terminal year.

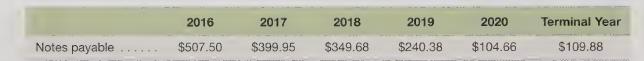

14. Notes payable are assumed to be as shown in the below table.

15. Common stock is assumed to be a constant \($110\) and then grow at a 5 percent rate in the terminal year.

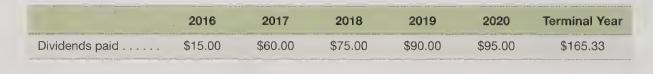

16. Retained earnings is assumed to grow at the rate of annual net income less dividends paid. Dividends are assumed to be as shown below.

17. Assumed terminal year growth is 5 percent.

18. Kat Company’s cost of common equity is 10 percent.

Required

1. Prepare pro forma income statements, balance sheets, and statements of cash flow for the five-year period 2016 through 2020, along with the terminal year.

2. Determine the company’s free cash flow for the five-year period 2016 through 2020, along with the terminal year.

3. Determine the equity value of Kat Company using the residual income method.

4. Determine the equity value of Kat Company using the discounted cash flow method.

Step by Step Answer:

Financial Accounting For Executives And MBAs

ISBN: 9781618531988

4th Edition

Authors: Wallace, Simko, Ferris