Lowes Companies Inc. is the second largest retailer of home improvement products in the world, with a

Question:

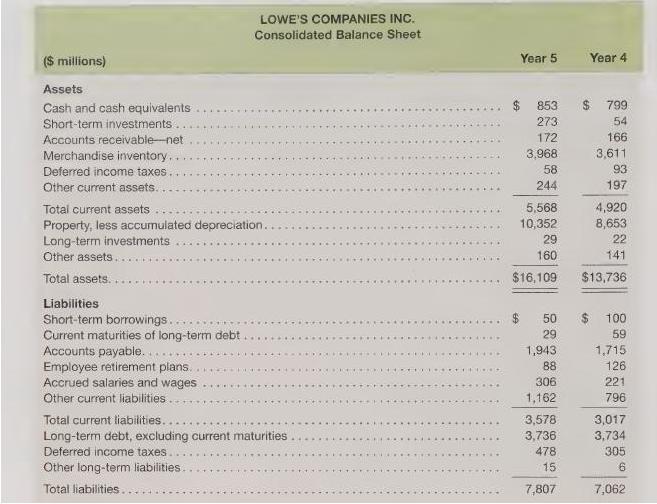

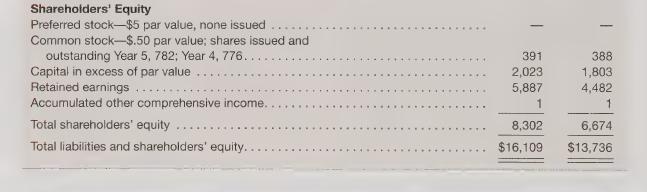

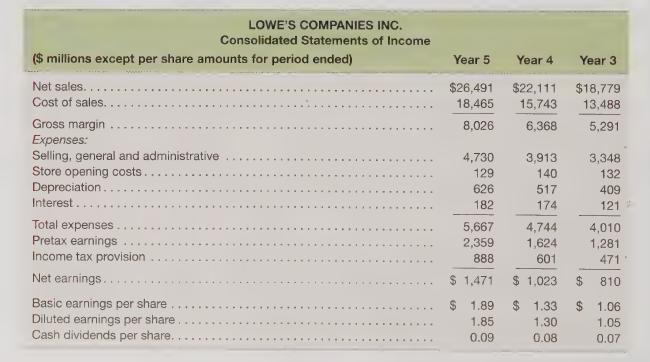

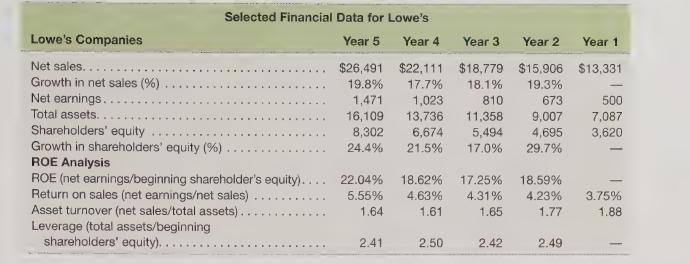

Lowe’s Companies Inc. is the second largest retailer of home improvement products in the world, with a specific emphasis on retail do-it-yourself (DIY) and commercial business customers. Lowe’s specializes in offering products and services for home improvement, home decor, home maintenance, home repair and remodeling, and maintenance of commercial buildings.

Required

Assume that on July 8, Year 6, Lowe’s stock price closed at \($45.30\) per share. An analyst at a prominent Wall Street bank set a price target of \($52\) per share based on an EPS forecast of \($2.22\) per share for fiscal Year 6.

Assume that the company’s cost of equity is 14 percent. Use the Residual Income valuation model to calculate the equity value of the Lowe’s Companies. [As a base case, a company whose expected ROE is 25 percent per year, whose cost of equity is 14 percent, and whose growth in book value is expected to be 20 percent per year for the first ten years and five percent per year thereafter, would have an intrinsic value of 4.015 times current book value.] Do you think Lowe’s is worth \($52\) per share? Why?

Step by Step Answer:

Financial Accounting For Executives And MBAs

ISBN: 9781618531988

4th Edition

Authors: Wallace, Simko, Ferris