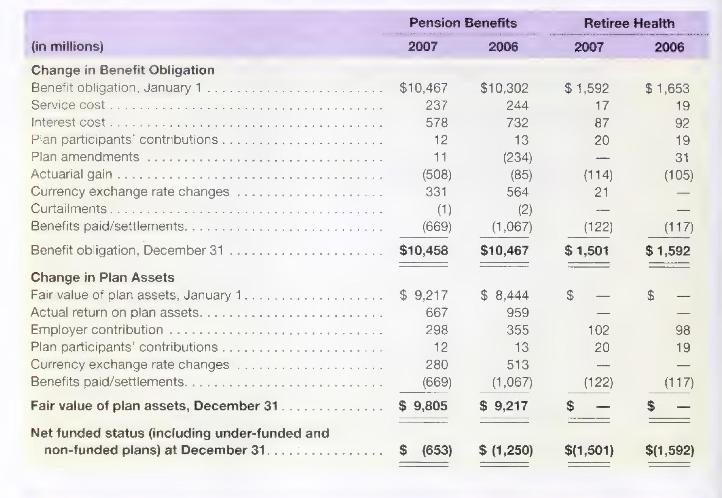

Xerox reports the following pension and retiree health care (Other) footnote as part of its (10-mathrm{K}) report.

Question:

Xerox reports the following pension and retiree health care ("Other") footnote as part of its \(10-\mathrm{K}\) report.

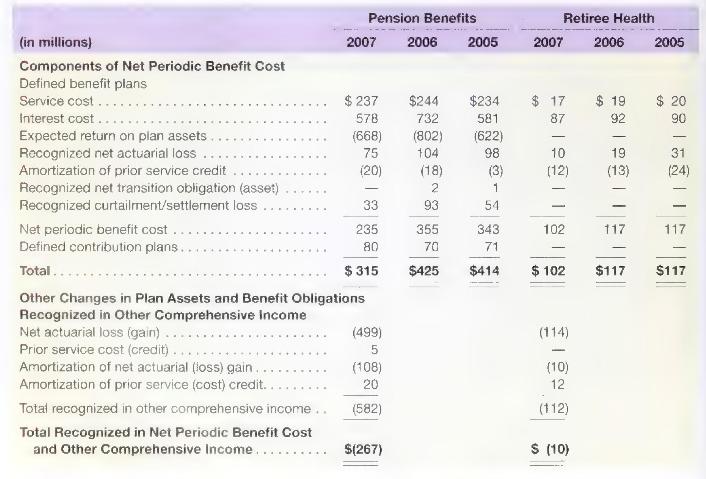

a. Describe what is meant by service cost and interest cost (the service and interest costs appear both in the reconciliation of the \(\mathrm{PBO}\) and in the computation of pension expense).

b. What is the actual return on the pension and the health care ("Other") plan investments in 2007? Was Xerox's profitability impacted by this amount?

c. Provide an example under which an "actuarial gain," such as the \(\$ 508\) million gain in 2007 that Xerox reports, might arise

d. What is the source of funds to make payments to retirees?

e. How much cash did Xerox contribute to its pension and health care plans in 2007?

f. How much cash did retirees receive in 2007 from the pension plan and the health care plan? How much cash did Xerox pay these retirees in 2007?

g. Show the computation of the 2007 funded status for the pension and health care plans.

h. The company reports \(\$ 108\) million "amortization of net actuarial (loss) gain" in the table relating to Other Comprehensive Income and \(\$ 75\) million "Recognized net actuarial loss" and \(\$ 33\) million "Recognized curtailment/settlement loss" in the net periodic benefit cost table. (Note that \(\$ 75\) million \(+\$ 33\) million \(=\$ 108\) million.) The company also reports a \(\$ 20\) million "Amortization of prior service (cost) credit" and a corresponding amount in the net periodic benefit cost table. Describe the process by which these amounts are transferred from Other Comprehensive Income to pension expense in the income statement.

Step by Step Answer:

Financial Accounting For MBAs

ISBN: 9781934319345

4th Edition

Authors: Peter D. Easton, John J. Wild, Robert F. Halsey, Mary Lea McAnally