(a) Outline what profits are available for distribution by each of the following: (i) A private limited...

Question:

(a) Outline what profits are available for distribution by each of the following: (i) A private limited company; and (ii) A public limited company.

(b) You are given the following extracts from the draft statement of comprehensive income of MORGAN ENTERPRISES for the year ended 31 December 1998:

Draft Statement of comprehensive income Extracts for the Year Ended 31 December 1998

The following additional information is also available:

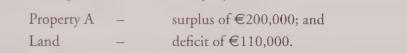

1. During 1998 two of the company’s assets were revalued as follows:

2. With respect to Property A, the depreciation charge for 1998 had been based on the revalued amount of the asset. The depreciation charge for 1998 was €30,000 more than would have been charged on a historical cost basis.

3. A flood occurred in the main warehouse of MORGAN ENTERPRISES just before the year end and inventory worth €70,000 was destroyed. No adjustment has been made for this in the draft statement of comprehensive income.

4. Just before the year end, 2 employees were made redundant at a total cost of €20,000.

No adjustment has been made for this in the draft statement of comprehensive income.

5. Deferred development expenditure in the statement of financial position of MORGAN ENTERPRISES at 31 December 1998 amounted to €1,000,000.

6. An increase in trade investments before the year end, amounting to €150,000, had not been reflected in the financial statements.

7. A portion of the company car park was sold before the year end, yielding an after-tax profit of €900,000. No adjustment has been made for this in the draft profit and loss account.

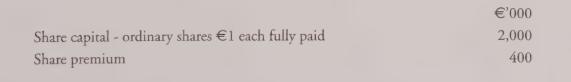

8. The company is financed by equity capital as follows:

9. Retained profits at 1 January 1998 were €2,800,000.

10. The tax rate is 20%

Requirement

(a) Assuming that MORGAN ENTERPRISES is a private limited company, show what profits are available for distribution.

(b) Assuming that MORGAN ENTERPRISES is a public limited company, show what profits are available for distribution.

(c) Would your answers in

(a) and

(b) above have been any different if all of the company’s non-current assets had been revalued during the year?

Step by Step Answer:

International Financial Accounting And Reporting

ISBN: 9780903854726

2nd Edition

Authors: Ciaran Connolly