Samsung is a leading global manufacturer that competes with Apple and Google. Key financial figures for Samsung

Question:

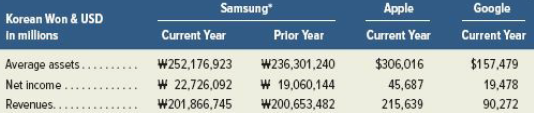

Samsung is a leading global manufacturer that competes with Apple and Google. Key financial figures for Samsung follow.

Required

1. What is the return on assets for Samsung in the (a) current year and (b) prior year?

2. Does Samsung?s return on assets exhibit a favorable or unfavorable trend?

3. Is Samsung?s current-year return on assets better or worse than that for (a) Apple and (b) Google?

Transcribed Image Text:

Samsung Apple Korean Won & USD In millions Google Current Year Prior Year Current Yoar Current Yoar Average assets.. Net income .. W252,176,923 W 22,726,092 W201,866,745 W236,301,240 W 19,060,144 W200,653,482 $306,016 45,687 215,639 $157,479 19,478 90,272 Revenues.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 66% (21 reviews)

1 a 90 Explanation Return on assets is net income divided by the average to...View the full answer

Answered By

Deepak Pal

Hi there! Are you looking for a committed, reliable, and enthusiastic tutor? Well, teaching and learning are more of a second nature to me, having been raised by parents who are both teachers. I have done plenty of studying and lots of learning on many exciting and challenging topics. All these experiences have influenced my decision to take on the teaching role in various capacities. As a tutor, I am looking forward to getting to understand your needs and helping you achieve your academic goals. I'm highly flexible and contactable. I am available to work on short notice since I only prefer to work with very small and select groups of students. Areas of interest: Business, accounting, Project management, sociology, technology, computers, English, linguistics, media, philosophy, political science, statistics, data science, Excel, psychology, art, history, health education, gender studies, cultural studies, ethics, religion. I am also decent with math(s) & Programming. If you have a project you think I can take on, please feel welcome to invite me, and I'm going to check it out!

5.00+

1+ Reviews

10+ Question Solved

Related Book For

Financial Accounting Information for Decisions

ISBN: 978-1259917042

9th edition

Authors: John J. Wild

Question Posted:

Students also viewed these Business questions

-

What is the return on assets ratio?

-

What information does the return on assets ratio provide about a company?

-

Global Industries has calculated the return on assets (ROA) for one of its projects using the simulation method. By simulating the operations 1,000 times, they obtained an ROA of 16.7 percent and a...

-

Suppose the money supply is $250 million dollars and the demand for money is given by Qm D = 400 - 40i, where Qm D is in millions of dollars. A. What is the equilibrium interest rate in this economy?...

-

Enrico has planned to have $40,000 at the end of 10 years to place a down payment on a condo. Property taxes and insurance can be as much as 30% of the monthly principal and interest payment (i.e.,...

-

Bell Microsystems Limited Established in 1997, Bell Microsystems is an IT infrastructure solution provider, based in Portsmouth. Bell Microsystems use several Sage products including Sage Line 50,...

-

Evaluate capital expenditure proposals using the payback period method. LO.1

-

Assume that EBV and Talltree invested in Newco at the terms in Exercises 10.2 and 10.3, and it is now one year later. Owl is considering a $20M Series C investment in Newco. Talltree proposes to...

-

Which of the following statements is true regarding the FASB Accounting Standards Codification (ASC)? Multiple Choice Only the FASB may issue pronouncements which lead to changes in the ASC. Only the...

-

Paul Jordan has just been hired as a management analyst at Digital Cell Phone, Inc. Digital Cell manufacturers a broad line of phones for the consumer market. Pauls boss, John Smithers, chief...

-

Use the information in Problem 1-3A to prepare a year-end statement of retained earnings for Armani Company. $10,000 9,000 $ 6,000 13,000 33,000 22,000 20,000 Retained earnings, Dec. 31,2018....

-

Visit the EDGAR database at SEC.gov. Access the Form 10-K report of Rocky Mountain Chocolate Factory (ticker: RMCF) filed on May 23, 2016, covering its 2016 fiscal year. Required 1. Item 6 of the...

-

Calculate Computrons return on invested capital. Computron has a 10% cost of capital (WACC). Do you think Computrons growth added value?

-

The problem I have identified is that healthcare leaders could benefit from addressing the issue of stress and burnout, which impact revenue (Scott, 2022). I have found a peer-reviewed article...

-

Facebook, Inc is the company Complete a 3-5 year forecast for your target company assuming a 10% average growth rate for the duration of the forecast period Assuming a long-term growth rate of 5%...

-

BSC-It is important for healthcare leaders to link their departmental balanced scorecard (BSC) to a corporate BSC because it facilitates alignment with the overall strategic objectives of the...

-

Hebert Company adds material at the beginning of production. The following production information is available for March: Beginning Work in Process Inventory (40% complete as to conversion) Started...

-

What modifications would you suggest the leaders of the steel organization when dealing with the use of more efficient technology, carbon emissions, and negative economic impacts in order tomake in...

-

Use the chain rule to differentiate each of the following functions: a. y = (x + 3) 4 b. y = (2x + 3) 4 c. y = (x 2 + 3) 4 d. y = x + 3 e. y = 2x + 3 f. y = x 2 + 3

-

Use this circle graph to answer following Exercises. 1. What fraction of areas maintained by the National Park Service are designated as National Recreation Areas? 2. What fraction of areas...

-

Is it possible to evaluate a cost centers profitability? Explain.

-

Is it possible to evaluate a cost centers profitability? Explain.

-

What is the difference between direct and indirect expenses?

-

! Required information [ The following information applies to the questions displayed below. ] Year 1 total cash dividends Year 2 total cash dividends Year 3 total cash dividends Year 4 total cash...

-

Built-Tight is preparing its master budget for the quarter ended September 30, 2015. Budgeted sales and cash payments for product costs for the quarter follow: July August September Budgeted sales $...

-

inepired. 2. Suppliei on hard at the eind of the month tedaled $16800. 2 The balance in Prepaid Rent represucks 4 months of rent coves. 5. Desreciationet bullines is $5060 per vear

Study smarter with the SolutionInn App