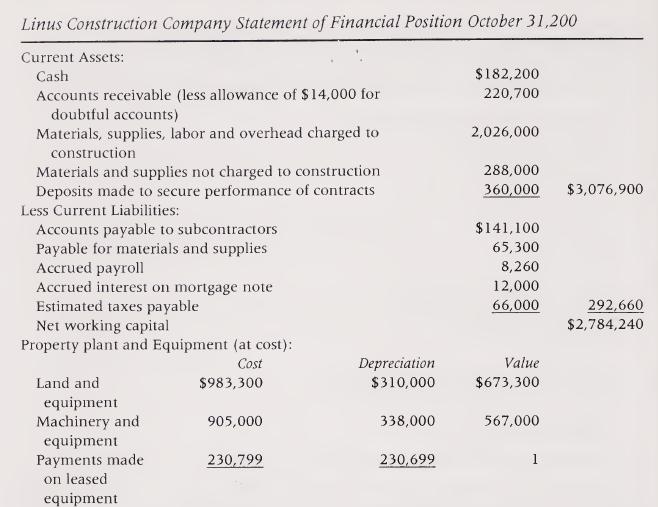

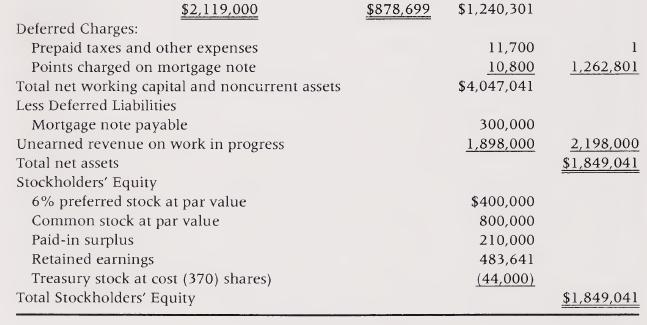

The financial statement was prepared by employees of your client, Linus Construction Company. The statement is not

Question:

The financial statement was prepared by employees of your client, Linus Construction Company.

The statement is not accompanied by footnotes, but you have discovered the following:

a. The average completion period for the company's jobs is 18 months. The company's method of journalizing contract transactions is summarized in the following pro-forma entries.

b. Linus both owns and leases equipment used on construction jobs. Typ¬ ically, its equipment lease contracts provide that Linus may return the equipment upon completion of a job or may apply all rentals in full toward purchase of the equipment. About 70 percent of lease rental payments made in the past have been applied to the purchase of equip¬ ment. While leased equipment is in use, rents are charged to the account payments made on leased equipment (except for $1 balance) and to jobs on which the equipment has been used. In the event of purchase, the bal¬ ance in the payments made on leased equipment account is transferred to the machinery and equipment account and the depreciation and other related accounts are corrected.

c. Management is unable to develop dependable estimates of costs to com¬ plete contracts in progress.

Required:

a. Identify the weaknesses in the financial statement.

b. For each item identified in part (a), indicate the preferable treatment and explain why the treatment is preferable.

Step by Step Answer:

Financial Accounting Theory And Analysis Text And Cases

ISBN: 9780470128817

9th Edition

Authors: Richard G. Schroeder, Myrtle W. Clark, Jack M. Cathey