The statement of comprehensive income for the year ended 31 December 2005 of CLINIC Limited (CLINIC) and

Question:

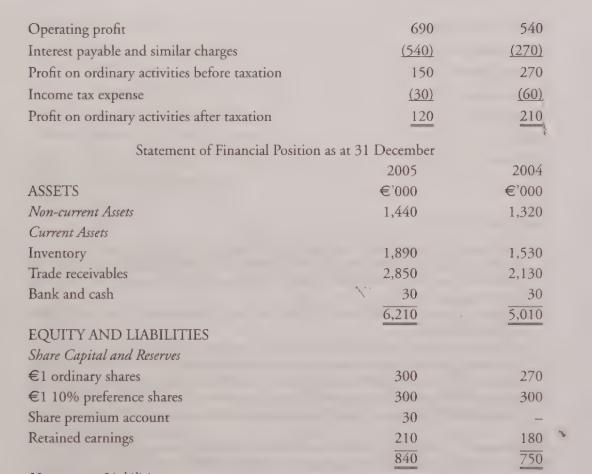

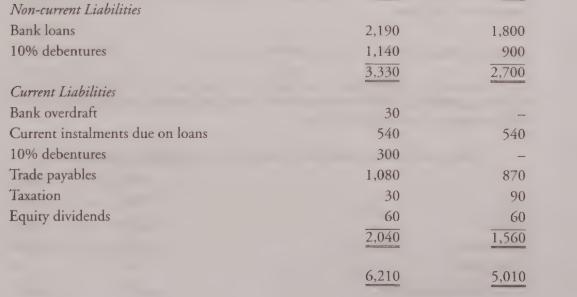

The statement of comprehensive income for the year ended 31 December 2005 of CLINIC Limited (CLINIC) and a statement of financial position as at that date, together with comparative figures, are as follows.

Statement of Comprehensive Income for the Year Ended 31 December

Additional Information:

d On 1 July 2005, CLINIC issued 60,000 €1 ordinary shares at €2 per share. Additionally, CLINIC purchased and cancelled 30,000 of its own €1 ordinary shares on 1 October 2005 at €2 per share.

During the year ended 31 December 2005, CLINIC sold non-current assets with a net book value of €90,000, which had originally cost €750,000, for cash. Included in trade payables at 31 December 2005 is an amount of €450,000 in respect of non-current assets purchased during the year ended 31 December 2005.

. Depreciation of €600,000 was charged during the year ended 31 December 2005.

This amount is included in ‘other operating expenses’, together with a profit on disposal on non-current assets of €60,000. Also included in other operating expenses is €30,000 paid in connection with the issue and purchase of ordinary shares during the year.

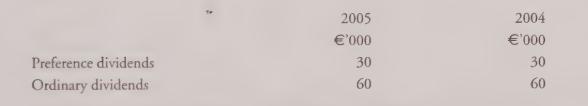

. During the year ended 31 December 2005, the following dividends were debited to equity:

Step by Step Answer:

International Financial Accounting And Reporting

ISBN: 9780903854726

2nd Edition

Authors: Ciaran Connolly