Marie has 11,000 that she wishes to invest for one year. She has narrowed her choices down

Question:

Marie has 11,000 that she wishes to invest for one year. She has narrowed her choices down to one of the following two actions:

a : Buy bonds of Risky Mining Ltd. These pay 14.4% interest, unless Risky goes bankrupt, in which case Marie wLU lose her principal and interest, a : Buy Canada Savings bonds, paying 6.4% interest.

Marie assesses her prior probability of Risky Mining Ltd. going bankrupt as .40.

Marie's utility for money is given by the square root of the amount of her gross payoff That is, if she buys the Canada Savings Bonds her payoff is $1,064, etc.

Marie is a rational decision-maker.

Required

a. Based on her prior probabilities, which action should Marie take? Show your calculations.

b. Before making a final decision, Marie decides she needs more information.

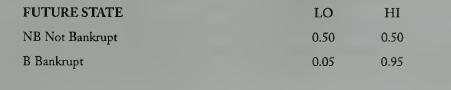

She obtains Risky Mining's current financial statements and examines its debt-to-equity ratio. This ratio can be either "HI" or "LO." Upon calculating the ratio, Marie observes that it is LO. On the basis of her prior experience in bond investments, Marie knows the foUovwng conditional probabilities:

Which action should Marie now take? Show your calculations, taken to two decimal places.

c. The Accounting Standards Board adopts a major new standard affecting Risky Mining Ltd.'s financial statements. Pension habilities and other postretirement benefits must now be measured in the financial statements at their expected discounted present values, instead of the previous pay-asyou-

go accounting.

Evaluate the likely impact of the new standard on the main diagonal probabilities of the information system in part b.

Step by Step Answer: