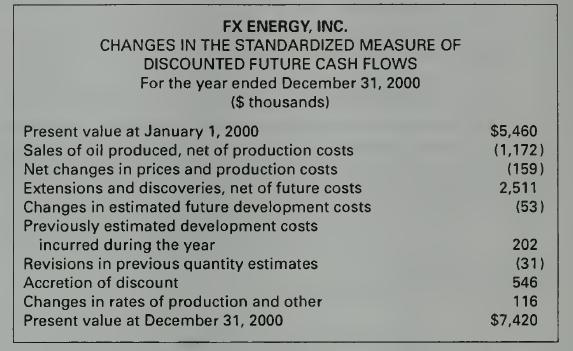

The following RRA. information is taken from the December 31, 2000, annual report of FX Energy, Inc.

Question:

The following RRA. information is taken from the December 31, 2000, annual report of FX Energy, Inc.

Required

a. Prepare income statements, similar to Table 2.5, in both the "sales less amortization" format and the "alternative" format.

b. Explain why amortization expense for 2000 is negative. FX Energy reports elsewhere in its annual report an (historical cost-based) operating loss from exploration and production for 2000 of $7,245. While all of this amount may not derive from proved reserves, take this operating loss as a reasonable historical cost-based analogue of the RRA income you calculated in part

a. Also explain why RRA income for 2000 is different from the $7,245 loss under historical cost.

c. Explain why the standardized measure is applied only to proved reserves under SFAS 69.

d. SFAS 69 mandates a discount rate of 10% for the RRA present value calcu- lations, rather than allowing each firm to choose its own rate. Why? Can you see any disadvantages to mandating a common discount rate? Note: The item "extensions and discoveries, net of future costs" represents additional reserves proved during the year. Treat it as a separate abnormal earnings item in the alternative income statement. The item "changes in rates of production and other" represents changes in timing of extraction from the timing that was expected at the beginning of 2000.

Step by Step Answer: