The text states that matching of costs and revenues is a major challenge of historical cost accounting.

Question:

The text states that matching of costs and revenues is a major challenge of historical cost accounting. Another challenge is revenue recognition, that is, when to recog- nize revenue as realized, or earned. Most firms recognize revenue as earned at the point of sale. More generally, revenue from sale of goods should be recognized when the significant risks and rewards of ownership are transferred to the buyer, and reasonable assurance exists with respect to the amount of consideration to be received.

For services and long-term contracts, revenue should be recognized as the work is performed, providing there is reasonable assurance of the amount of consideration that will be received from the service or contract (see CICA Handbook, Section 3400).

It is often not clear just when these general criteria are met. Furthermore, firms with no earnings history (e.g., startup firms) and firms that are incurring significant losses or decHnes in earnings have an incentive to record revenue as early as possible, so as to improve the appearance of their financial statements.

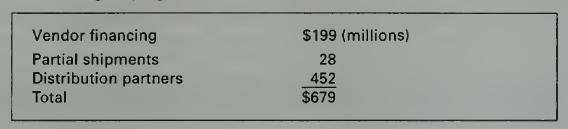

Consider the case of Lucent Technologies Inc. In December 2000, Lucent restated its revenue for its fiscal year ended September 30, 2000, reducing the amounts originally reported as follows:

The vendor financing component of the restatement represents previously unrecorded credits granted by Lucent to customers, to help them finance pur- chases of Lucent products. That is, the customer sales were originally recorded gross, rather than net, of the credits. The distribution partners component rep- resents product shipped to firms with which Lucent did not deal at arms length, but which was not resold by these firms at year end. These firms included cer- tain distributors in which Lucent had an ownership interest. The practice of over-shipping to distributors is called "stuffing the channels." On February 9, 2001, The Wall Street Journal reported that the SEC was launch- ing an investigation into possible fraudulent accounting practices at Lucent Technologies, arising from the original recording of the above revenue items. In its 2000 Annual Report, Lucent reported net income of \($1,219\) (millions), compared to \($4,789\) millions for 1999 and \($1,065\) millions for 1998. Required

a. What is the most relevant point of revenue recognition? The most reliable? Explain.

b. Do you feel that Lucent's original recognition of the above components as revenue was consistent with the general revenue recognition criteria given above? Explain why or why not. In your answer, consider the tradeoff between relevance and reliability.

c. What additional revenue recognition questions arise when the vendor has an ownership interest in the customer?

Step by Step Answer: