The following information was reported by Ford Motor Company in its 1998 annual report. (a) Determine the

Question:

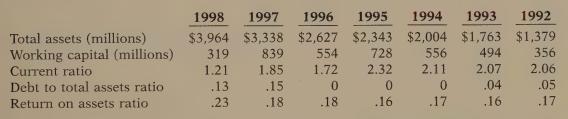

The following information was reported by Ford Motor Company in its 1998 annual report.

(a) Determine the overall percentage increase in Ford's total assets from 1992 to 1998.

What was the average increase per year?

(b) Comment on the change in Ford’s liquidity. Does working capital or the current ratio appear to provide a better indication of Ford’s liquidity? What might explain the change in Ford's liquidity during this period?

(c) Comment on the change in Ford’s solvency during this period.

(d) Comment on the change in Ford's profitability during this period. Ignoring 1998, what was the average value of Ford’s return on assets ratio during 1992 to 1997? How might this affect your prediction about Ford’s future profitability?

A GLOBAL FOCUS

Step by Step Answer:

Financial Accounting Tools For Business Decision Making

ISBN: 9780471347743

2nd Edition

Authors: Paul D. Kimmel, Jerry J. Weygandt, Donald E. Kieso