A, B and C are partners in a firm of accountants who maintain accounts on a cash

Question:

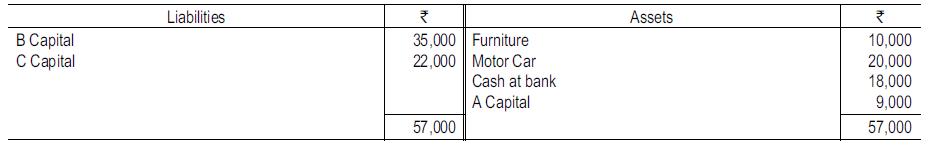

A, B and C are partners in a firm of accountants who maintain accounts on a cash basis sharing profits and losses in the ratio of 2:3:1. Their Balance Sheet as on March 31, 2018 on which date D is admitted as a partner, is as follows: D is given 1/4 share of the profits and losses in the firm and the profit and loss sharing ratio as between the other partners remains as before. The following adjustments are to be made prior to D’s admission:

D is given 1/4 share of the profits and losses in the firm and the profit and loss sharing ratio as between the other partners remains as before. The following adjustments are to be made prior to D’s admission:

(a) The motor car is taken over by B at a value of ₹25,000.

(b) The furniture is revalued at ₹18,000.

(c) Goodwill is valued at ₹50,000. It is agreed among A, B and C that C is interested in goodwill only up to a value of ₹30,000.

(d) Fees billed but not realized ₹11,000 are brought into account.

(e) Expenses incurred but not paid, ₹3,000 are provided for.

D brings in ₹20,000 in cash as his capital contribution. He is also to be credited with ₹20,000 for having agreed to amalgamate his separate practice as Chartered Accountant with this firm. The partners have decided not to show any goodwill in their new books of account.

Pass necessary Journal entries and prepare the Balance Sheet of the firm after D’s admission.

Step by Step Answer:

Financial Accounting Volume II

ISBN: 9789387886230

4th Edition

Authors: Mohamed Hanif, Amitabha Mukherjee