A, B and C were partners in a firm sharing profits and losses in the ratio of

Question:

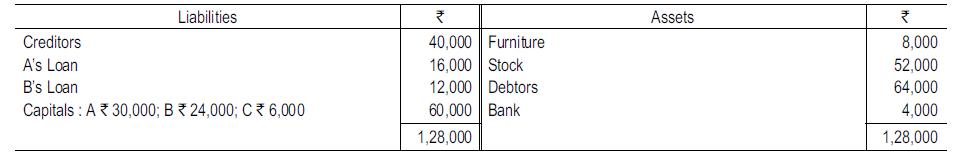

A, B and C were partners in a firm sharing profits and losses in the ratio of 5 : 3 : 2. On 31.3.2017, their Balance Sheet was as follows:

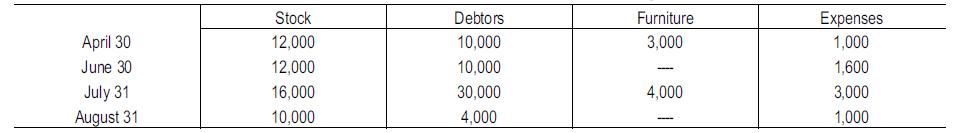

The firm was dissolved on 1.4.2017. The assets realised were as follows (all figures in ₹) :

Cash received was paid to the rightful claimants at the end of each month. Prepare the statement showing the distribution of cash.

Transcribed Image Text:

Liabilities Creditors A's Loan B's Loan Capitals A30,000; B 24,000; C 6,000 ₹ 40,000 Furniture 16,000 Stock 12,000 Debtors 60,000 Bank 1,28,000 Assets ₹ 8,000 52,000 64,000 4,000 1,28,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (6 reviews)

The statement showing the distribution of cash Date Amount received Paid to Balance April 30 12000 C...View the full answer

Answered By

User l_998468

I have extensive tutoring experience, having worked as a private tutor for over three years. I have tutored students from different academic levels, including high school, undergraduate, and graduate levels. My tutoring experience has taught me to be patient, attentive to student needs, and effective in communicating difficult concepts in simple terms.

I have a strong background in statistics, probability theory, data analysis, and data visualization. I am proficient in using statistical software such as R, Python, and SPSS, which are commonly used in academic research and data analysis. Additionally, I have excellent communication and interpersonal skills, which enable me to establish rapport with students, understand their learning styles, and adapt my teaching approach to meet their needs.

I am passionate about teaching and helping students achieve their academic goals.

0.00

0 Reviews

10+ Question Solved

Related Book For

Financial Accounting Volume II

ISBN: 9789387886230

4th Edition

Authors: Mohamed Hanif, Amitabha Mukherjee

Question Posted:

Students also viewed these Business questions

-

A, B and C were partners in a firm sharing profits and losses in the ratio of 2 : 2 : 1 respectively. The Balance Sheet of the firm as on 31.12.2017 was as follows: On 31.12.2017, B retired. The...

-

A, B and C were partners in a firm dealing in toilet articles and share profits and losses in the ratio of 4 : 3 : 3. As of December 31, 2017 they decided to dissolve the firm and B was appointed to...

-

A, B and C were partners in a firm sharing profits and losses in the ratio of 3 : 2 : 1. They decided to dissolve the firm when the state of affairs was as follows: Investment was fully taken by A in...

-

Suppose you own an outdoor recreation company and you want to purchase all-terrain vehicles (ATVs) for your summer business and snowmobiles for your winter business. Your budget for new vehicles this...

-

If selling price per unit is $30, variable costs per unit are $20, total fixed costs are $10,000, the tax rate is 30%, and the company sells 5,000 units, net income is: a. $12,000 b. $14,000 c....

-

How does the price of an option and the exercise price affect the payoff from an option.

-

Standard cost is a historical cost.

-

On June 3, Arnold Limited sold to Chester Arthur merchandise having a sale price of $3,000 with terms 3/10, n/60, f.o.b. shipping point. A $90 invoice, terms n/30, was received by Chester on June 8...

-

Sloan Corporation is considering new equipment. The equipment can be purchased from an overseas supplier for $3,200. The freight and installation costs for the equipment are $620. If purchased,...

-

Linken Ltd. with a Head Office in Calcutta opened a branch on January 1, 2017, at Kanpur where all sales were to be made on credit basis. All goods required by the branch were supplied by the company...

-

P,Q and R are partners sharing profits and losses in the ratio of 1/4:1/4:1/2. They decided to dissolve their business on 31.3.2018, when their Balance Sheet was as follows: P is insolvent....

-

Should the IRS audit more or fewer returns every year? What issues would you consider in this regard if you were a politician? A wealthy individual?

-

Coaching for Performance Develop a strategy for how you will approach the coaching session with the employee, including what you plan to discuss and any questions you may have when you debrief....

-

For the following exercises, find the derivatives of the given functions: 1. y=x-secx+1 2. y = 3 cscx+ 5 3. f(x) = x cotx 4. f(x) = secx I 5. y=

-

1. why does Amazon use ERP system? How does ERP system work for Amazon? what are the benefit and drawbacks of using ERP for Amazon? 2. what are 5 industry best practices across Finance,...

-

A rigid vessel contains afuel gasconsisting of a methane (CH4) and ethane (C2H6) mixture. The pressure in the vessel is found to be 0.30 bar.Air is added to the vessel until the total pressure...

-

Do you agree with this discussion post? My article discusses decision-making tools in Project Management (PM). "In research and development (R&D), project management (PM) decision-making tools are...

-

(a) What is the resistance per meter of a gold wire with a cross-sectional area of 1.6 10-7 m2? (b) Would your answer to part (a) increase, decrease, or stay the same if the diameter of the wire...

-

An 8.0 kg crate is pulled 5.0 m up a 30 incline by a rope angled 18 above the incline. The tension in the rope is 120 N, and the crates coefficient of kinetic friction on the incline is 0.25. a. How...

-

The following selected transactions were completed during April between Swan Company and Bird Company: Apr. 2. Swan Company sold merchandise on account to Bird Company, $32,000, terms FOB shipping...

-

The following selected transactions were completed during April between Swan Company and Bird Company: Apr. 2. Swan Company sold merchandise on account to Bird Company, $32,000, terms FOB shipping...

-

Selected transactions for Niles Co. during March of the current year are listed in Problem 5-1B. In Problem 5-1B. The following selected transactions were completed by Niles Co. during March of the...

-

Series of Compound Interest Techniques The following are several situations involving compound interest. Required: Using the appropriate table, solve each of the following: ( Click here to access the...

-

If Clark Kelly has recognized gain on an exchange of like-kind property held for investment use, where does Clark report the gain? First on Form 8824, then carried to Schedule D. First on Form 8824,...

-

An investor put 40% of her money in Stock A and 60% in Stock B. Stock A has a beta of 1.2 and Stock B has a beta of 1.6. If the risk-free rate is 5% and the expected return on the market is 12%,...

Study smarter with the SolutionInn App