A recent annual report for Adobe Inc. contained the following data: Required: 1. Determine the receivables turnover

Question:

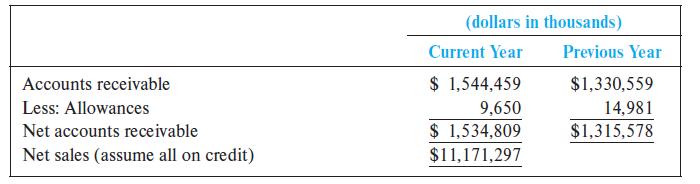

A recent annual report for Adobe Inc. contained the following data:

Required:

1. Determine the receivables turnover ratio and average days sales in receivables for the current year.

2. Explain the meaning of each calculated number.

Accounts receivable Less: Allowances Net accounts receivable Net sales (assume all on credit) (dollars in thousands) Current Year $ 1,544,459 9,650 $ 1,534,809 $11,171,297 Previous Year $1,330,559 14,981 $1,315,578

Step by Step Answer:

Req 1 Dollar amounts in thousands 1315578 1534809 2 Req 2 The ...View the full answer

Financial Accounting

ISBN: 9781264229734

11th Edition

Authors: Robert Libby, Patricia Libby, Frank Hodge

Related Video

Days sales outstanding (DSO) is a measure of the average number of days that it takes a company to collect payment for a sale. DSO is often determined on a monthly, quarterly, or annual basis. To compute DSO, divide the average accounts receivable during a given period by the total value of credit sales during the same period and multiply the result by the number of days in the period being measured.

Students also viewed these Business questions

-

A recent annual report for Dell, Inc., contained the following data: Required: 1. Determine the receivables turnover ratio and average days sales in receivables for the current year. 2. Explain the...

-

A recent annual report for Sears Holdings Corporation disclosed that the company paid preferred dividends in the amount of $119.9 million. It declared and paid dividends on common stock in the amount...

-

A recent annual report for FedEx Corporation contained the following data (in millions): May 31 2010 2009 Accounts Receivable.................................. $ 4,329......... $ 3,587 Less:...

-

Argue whether or not you believe using a sample of students from your schools cafeteria (you recruit the next 100 people to visit the cafeteria to participate) may or may not yield biased estimates...

-

Based on the case information provided, describe specifically how WorldCom violated the matching principle. In your description, please identify a journal entry that may have been used by WorldCom to...

-

Jewel Lyman is an employee in the office of Salvaggio & Wheelers, Attorneys at Law. She received the following benefits during 2018: Medical insurance, $250 per month Commuter pass, $500 per year...

-

0.270

-

In each of the following questions, you are asked to compare two options with parameters as given. The risk-free interest rate for all cases should be assumed to be 6%. Assume the stocks on which...

-

Lihue, Inc., applies fixed overhead at the rate of $3.40 per unit Budgeted fixed overhead was $1,196,460. This month 342,900 units were produced, and actual overhead was $1190,000. Required: a. What...

-

Liz Viera has opened Pizza and More, a wholesale grocery and pizza company. The following transactions occurred in March: Required 1. Journalize the transactions. 2. Record to the accounts receivable...

-

Tupperware Brands Corporation is engaged in the marketing, manufacture, and sale of design-centric preparation, storage and serving solutions for the kitchen and home and beauty products through...

-

Casilda Company uses the aging approach to estimate bad debt expense. The ending balance of each account receivable is aged on the basis of three time periods as follows: (1) not yet due, $50,000;...

-

A woman with type AB blood gave birth to a baby with type B blood. Two different men claim to be the father. One has type A blood, the other has type B blood. Can the genetic evidence decide in favor...

-

Idenfity whether the following book - tax adjustments are permanent or temporary differences. ( a ) Federal Income Tax Expense ( b ) Depreciation Expense ( c ) Accrued Compensation ( d ) Dividends...

-

2 . ) Pozycki, LLC has reported losses of $ 1 0 0 , 0 0 0 per year since its founding in 2 0 1 6 . For 2 0 2 3 , Pozycki anticipates a profit of about $ 1 0 0 , 0 0 0 . There are 3 equal members of...

-

Elena is a single taxpayer for tax year 2023. On April 1st, 2022, Elena's husband Nathan died. On July 13, 2023, Elena sold the residence that Elena and Nathan had each owed and used as their...

-

Rodriguez Corporation issues 12,000 shares of its common stock for $56,600 cash on February 20. Prepare journal entries to record this event under each of the following separate situations. 1. The...

-

Problem 3: A large rectangular plate is loaded in such a way as to generate the unperturbed (i.e. far-field) stress field xx = Cy; yy = -C x; Oxy = 0 The plate contains a small traction-free circular...

-

Design an FSM with one input, A, and two outputs, X and Y. X should be 1 if A has been 1 for at least three cycles altogether (not necessarily consecutively). Y should be 1 if A has been 1 for at...

-

An environmentalist wants to determine if the median amount of potassium (mg/L) in rainwater in Lincoln County, Nebraska, is different from that in the rainwater in Clarendon County, South Carolina....

-

Neighborhood Realty, Incorporated, has been operating for three years and is owned by three investors. S. Bhojraj owns 60 percent of the total outstanding stock of 9,000 shares and is the managing...

-

Assume that you are the president of Influence Corporation. At the end of the first year (December 31) of operations, the following financial data for the company are available: Cash...

-

Upon graduation from high school, Sam List immediately accepted a job as an electrician's assistant for a large local electrical repair company. After three years of hard work, Sam received an...

-

Given that rJ = 6.3%, rRF = 4.1%, and rM = 9.4%, determine the beta coefficient for Stock J that is consistent with equilibrium.

-

Simon Companys year-end balance sheets follow. At December 31 2017 2016 2015 Assets Cash $ 33,019 $ 37,839 $ 38,623 Accounts receivable, net 93,822 65,556 54,152 Merchandise inventory 117,963 89,253...

-

PLEASE REFER TO THE 2018 ANNUAL REPORT OF STARBUKS FOR THE YEAR FISCAL YR 2018, ENDING SEPTEMBER 30, 2018. Refer to the management discussion & analysis section and write a one page summary...

Study smarter with the SolutionInn App