A + T Williamson Company is making adjusting entries for the year ended December 31 of the

Question:

A + T Williamson Company is making adjusting entries for the year ended December 31 of the current year. In developing information for the adjusting entries, the accountant learned the following:

a. A two-year insurance premium of $4,800 was paid on October 1 of the current year for coverage beginning on that date. The bookkeeper debited the full amount to Prepaid Insurance on October 1.

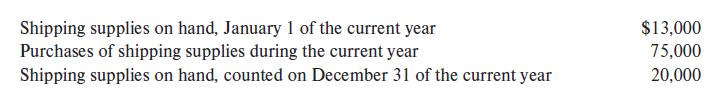

b. At December 31 of the current year, the following data relating to Shipping Supplies were obtained from the records and supporting documents.

Required:

1. Using the process illustrated in the chapter, record the adjusting entry for insurance at December 31 of the current year.

2. Using the process illustrated in the chapter, record the adjusting entry for supplies at December 31 of the current year, assuming that the shipping supplies purchased during the current year were debited in full to the account Shipping Supplies.

3. What amount should be reported on the current year’s income statement for Insurance Expense? For Shipping Supplies Expense?

4. What amount should be reported on the current year’s balance sheet for Prepaid Insurance? For Shipping Supplies?

Step by Step Answer:

Financial Accounting

ISBN: 9781264229734

11th Edition

Authors: Robert Libby, Patricia Libby, Frank Hodge