Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The required tasks are detailed below: (1) Prepare A common-size analysis [for 3 consecutive years]: Vertical analysis is performed for the income statement and balance

The required tasks are detailed below:

(1) Prepare A common-size analysis [for 3 consecutive years]:

Vertical analysis is performed for the income statement and balance sheet with comments

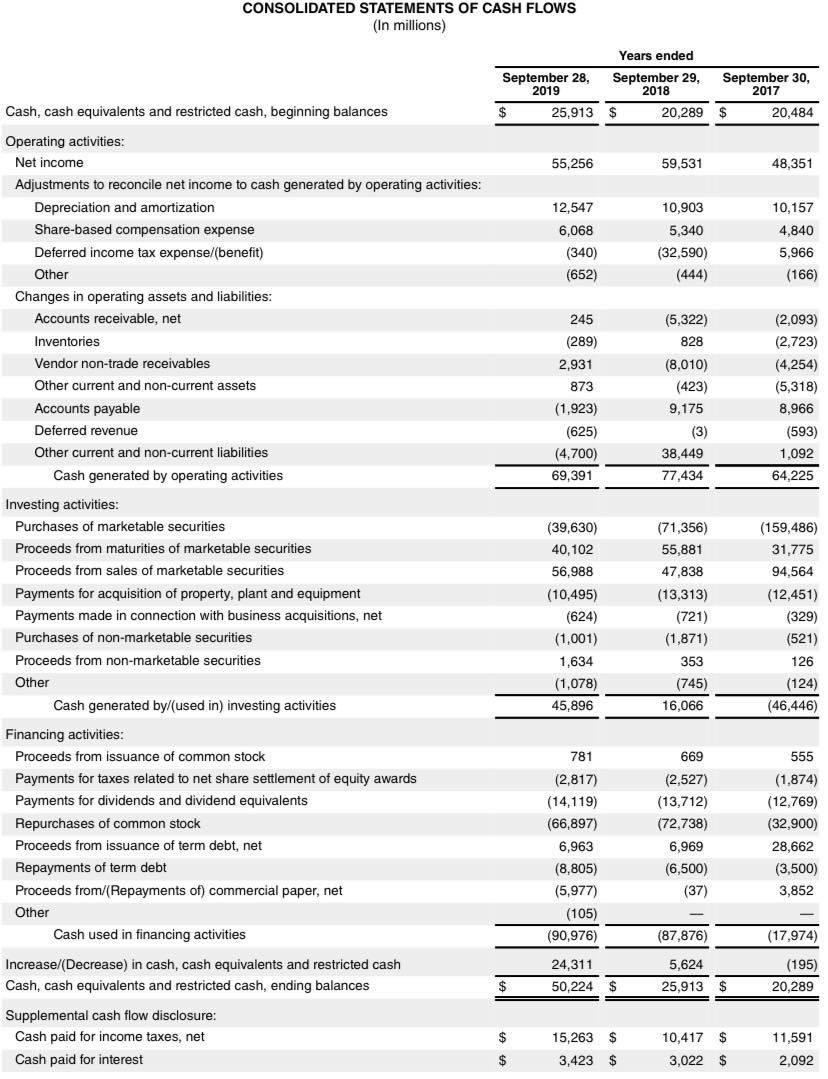

Horizontal analysis is performed for the income statement, balance sheet, and cash flow statement with comments

2) A Ratio analysis for each Company [for two consecutive years]:

Comprehensive analysis and comments on the improvement and/or the deterioration of the company’s liquidity. Profitability, market, solvency, and efficiency in the two years

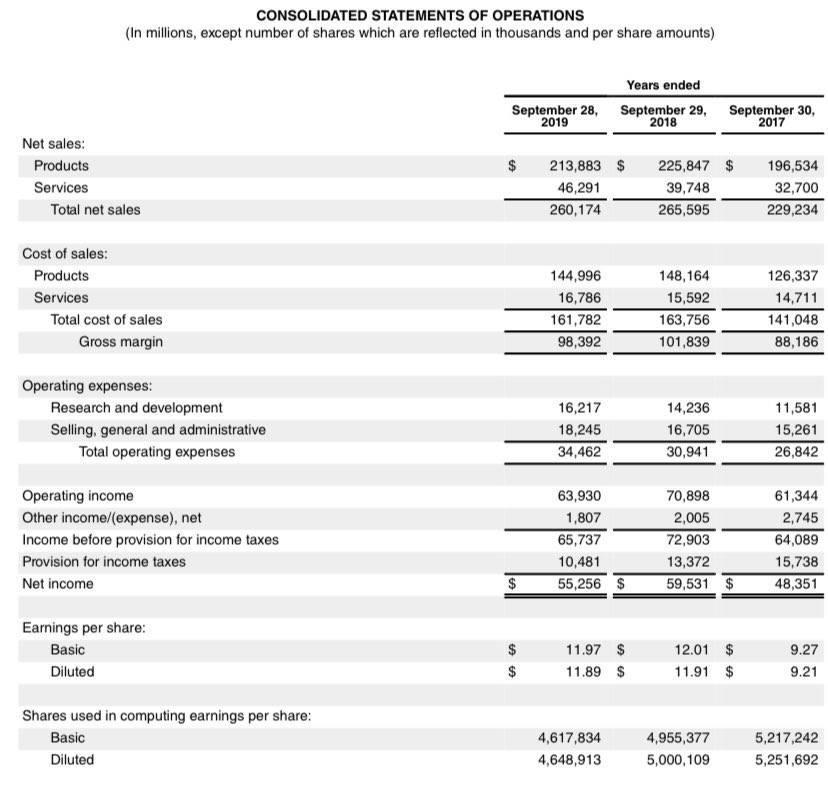

Net sales: Products Services CONSOLIDATED STATEMENTS OF OPERATIONS (In millions, except number of shares which are reflected in thousands and per share amounts) Total net sales Cost of sales: Products Services Total cost of sales Gross margin Operating expenses: Research and development Selling, general and administrative Total operating expenses Operating income Other income/(expense), net Income before provision for income taxes Provision for income taxes Net income Earnings per share: Basic Diluted Shares used in computing earnings per share: Basic Diluted September 28, 2019 $ S5 213,883 $ 46,291 260,174 144,996 16,786 161,782 98,392 16,217 18,245 34,462 Years ended September 29, September 30, 2017 2018 63,930 1,807 65,737 10,481 55,256 $ 11.97 $ 11.89 $ 4,617,834 4,648,913 225,847 $ 39,748 265,595 148,164 15,592 163,756 101,839 14,236 16,705 30,941 70,898 2,005 72,903 13,372 59,531 $ 12.01 $ 11.91 $ 4,955,377 5,000,109 196,534 32,700 229,234 126,337 14,711 141,048 88,186 11,581 15,261 26,842 61,344 2,745 64,089 15,738 48,351 9.27 9.21 5,217,242 5,251,692

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Question Answer 1 Common Size analysis Vertical Analysis Pariculars In Billions or local currency year 2019 In Billions or local currency year 2018 In Billions or local currency year 2017 Net Sales Re...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started