Amazon.com, Inc. (AMZN) is one of the largest Internet retailers in the world. Wal-Mart (WMT) is the

Question:

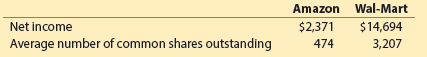

a. Determine the earnings per share for each company. Neither company had preferred stock outstanding. Round to the nearest cent.

b. Which company appears more profitable from an earnings-per-share perspective?

c. The market price of Amazon common stock was $750 per share at a time when Wal-Mart€™s was $69 per share. How would you explain this difference in market price given the earnings per share computed in (a) for both companies?

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial... Common Stock

Common stock is an equity component that represents the worth of stock owned by the shareholders of the company. The common stock represents the par value of the shares outstanding at a balance sheet date. Public companies can trade their stocks on...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Corporate Financial Accounting

ISBN: 9781337398169

15th Edition

Authors: Carl S. Warren, James M. Reeve, Jonathan Duchac

Question Posted: