Amazon.com, Inc., headquartered in Seattle, WA, started its electronic commerce business in 1995 and expanded rapidly. The

Question:

Amazon.com, Inc., headquartered in Seattle, WA, started its electronic commerce business in 1995 and expanded rapidly. The following transactions occurred during a recent year (dollars in millions):

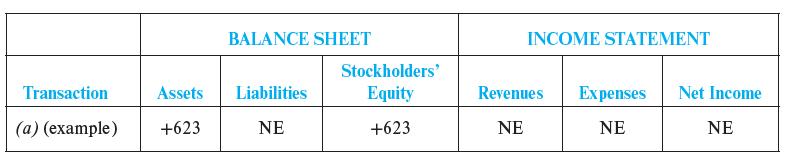

a. Issued stock for $623 cash (example).

b. Purchased equipment costing $6,320, paying $4,893 in cash and charging the rest on account.

c. Paid $5,000 in principal and $300 in interest expense on long-term debt.

d. Earned $280,522 in sales revenue; collected $223,949 in cash with the customers owing the rest on their Amazon credit card accounts.

e. Incurred $25,249 in shipping expenses, all on credit.

f. Paid $118,241 cash on accounts owed to suppliers.

g. Incurred $18,878 in marketing expenses; paid cash.

h. Collected $38,200 in cash from customers paying on their Amazon credit card accounts.

i. Borrowed $16,231 in cash as long-term debt.

j. Used inventory costing $165,536 when sold to customers. (The expense title for the using up of inventory sold to customers is Cost of Goods Sold.)

k. Paid $830 in income tax recorded as an expense in the prior year.

Required:

For each of the transactions, complete the tabulation, indicating the effect (+ for increase and − for decrease) of each transaction. (Remember that A = L + SE; R − E = NI; and NI affects SE through Retained Earnings.) Write NE if there is no effect. The first transaction is provided as an example.

Step by Step Answer:

Financial Accounting

ISBN: 9781264229734

11th Edition

Authors: Robert Libby, Patricia Libby, Frank Hodge