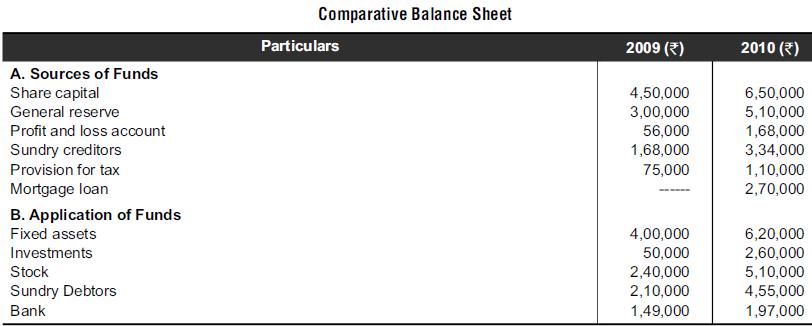

The managing director of Sigma Co-operative Bank has received the following facts from one of its clients.The

Question:

The managing director of Sigma Co-operative Bank has received the following facts from one of its clients.The bank is considering to sanction a working capital loan to this client.

Additional Information:

(i) Investments costing ₹ 80,000 were sold during the year 2009–10 for ₹ 85,000.

(ii) Provision for tax made during the year 2009–10 was ₹ 90,000.

(iii) During the year part of the fixed asset costing (book value) ₹ 1,00,000 was sold for ₹ 1,20,000 andprofit included in the profit and loss account.

(iv) Dividend paid during the year 2009–10 was ₹ 3,40,000.

Discussion Question

Assume that you are the credit officer of the bank, evaluate the profitability position, short-term liquidity and long-term solvency with the help of cash flow statement.

Step by Step Answer: