Blair, Inc., has the following plant asset accounts: Land, Buildings, and Equipment, with a separate accumulated depreciation

Question:

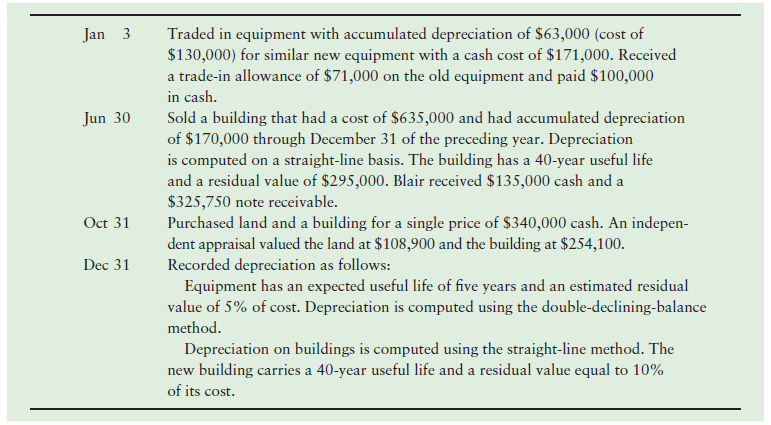

Blair, Inc., has the following plant asset accounts: Land, Buildings, and Equipment, with a separate accumulated depreciation account for each of these except Land. Blair completed the following transactions:

Requirement

1. Record the transactions in Blair’s journal.

Traded in equipment with accumulated depreciation of $63,000 (cost of $130,000) for similar new equipment with a cash cost of $171,000. Received a trade-in allowance of $71,000 on the old equipment and paid $100,000 Jan 3 in cash. Sold a building that had a cost of $635,000 and had accumulated depreciation of $170,000 through December 31 of the preceding year. Depreciation is computed on a straight-line basis. The building has a 40-year useful life and a residual value of $295,000. Blair received $135,000 cash and a $325,750 note receivable. Purchased land and a building for a single price of $340,000 cash. An indepen- dent appraisal valued the land at $108,900 and the building at $254,100. Recorded depreciation as follows: Equipment has an expected useful life of five years and an estimated residual value of 5% of cost. Depreciation is computed using the double-declining-balance Jun 30 Oct 31 Dec 31 method. Depreciation on buildings is computed using the straight-line method. The new building carries a 40-year useful life and a residual value equal to 10% of its cost.

Step by Step Answer:

Journal DATE ACCOUNT TITLES DEBIT CREDIT Jan 3 Equipment new 171000 Accumulate...View the full answer

Financial Accounting

ISBN: 978-0134725987

12th edition

Authors: C. William Thomas, Wendy M. Tietz, Walter T. Harrison Jr.

Related Video

In accounting terms, depreciation is defined as the reduction of the recorded cost of a fixed asset in a systematic manner until the value of the asset becomes zero or negligible. An example of fixed assets are buildings, furniture, office equipment, machinery, etc. The land is the only exception that cannot be depreciated as the value of land appreciates with time. Depreciation allows a portion of the cost of a fixed asset to be the revenue generated by the fixed asset. This is mandatory under the matching principle as revenues are recorded with their associated expenses in the accounting period when the asset is in use. This helps in getting a complete picture of the revenue

Students also viewed these Business questions

-

Pacific Energy Companys balance sheet includes the asset Iron Ore Rights. Pacific Energy paid $3.0 million cash for the right to work a mine that contained an estimated 240,000 tons of ore. The...

-

Atlantic Energy Companys balance sheet includes the asset Iron Ore Rights. Atlantic Energy paid $2.9 million cash for the right to work a mine that contained an estimated 225,000 tons of ore. The...

-

Jamison Sports Authority purchased inventory costing $25,000 by signing a 12%, six-month, short-term note payable. The purchase occurred on January 1, 2018. Jamison will pay the entire note...

-

The Sales Discounts account is a contra account to which of the following accounts? Cost of Goods Sold Sales Returns and Allowances Purchases Discounts Sales Revenue

-

Find the condition number of the following matrices. Which would you characterize as ill conditioned? (a)_ 3 999 .341 1.001 .388 o(L01 29997) (d) (-1 2-4) )1.00 1.9997 2 10 6 72 96 103 2 (e) 4255 59...

-

The file named FootballProblem8.xlsx shows statistics on NFL quarterbacks. Enter a QBs name in cell G3 and a statistic in cell H3. Then write a formula that returns in cell I3 the QBs statistic. 1...

-

Light from a very tiny lightbulb passes through a hole of diameter 0.15 m in a dark screen that is 2.5 m away (Fig. P24.1). Assume the light travels as ideal rays as it passes from the bulb, through...

-

Using the following data from the comparative balance sheet of Dotte Company, illustrate horizontalanalysis. December 31, 2014 $520,000 $840,000 $2,500,000 December 31, 2013 Accounts receivable...

-

Required information [The following information applies to the questions displayed below.) Hills Company's June 30 bank statement and the June ledger account for cash are summarized here: BANK...

-

The Jacksons are considering selling their current residence, buying a small home near Averys parents for $220,000 with a $100,000 30-year mortgage at 3.5%, and investing the net proceeds in their...

-

Forest Lake Resort reported the following on its balance sheet at December 31, 2018: Property, plant, and equipment, at cost: Land...................................................................

-

On January 3, 2018, Pawnee Company paid $230,000 for a computer system. In addition to the basic purchase price, the company paid a setup fee of $1,000, sales tax of $6,000, and $28,000 for a special...

-

Hernandez Company began 2010 with a $120,000 balance in retained earnings. During the year, the following events occurred: 1. The company earned net income of $80,000. 2. A material error in net...

-

Use the birth weights (grams) of the 400 babies listed in Data Set 6 "Births" in Appendix B. Examine the list of birth weights to make an observation about those numbers. How does that observation...

-

Listed below are annual U.S. sales of vinyl record albums (millions of units). The numbers of albums sold are listed in chronological order, and the last entry represents the most recent year. Do the...

-

From the following electrochemical cells write: (a) the electrode half reactions for oxidation and reduction (b) the overall cell reaction (c) the NERNST equation for the emf for each of the cells...

-

Use the range rule of thumb to identify the values that are significantly low, the values that are signficantly high, and the values that are neither significantly low nor significantly high. A test...

-

On January 1, Year 1, Handy Company (Handy) purchased 70% of the outstanding common shares of Dandy Limited (Dandy) for $11,900. On that date, Dandys shareholders equity consisted of common shares of...

-

For the following exercises, determine whether the functions are even, odd, or neither. Solve |2x 3 | = 17.

-

Cable Corporation is 60% owned by Anna and 40% owned by Jim, who are unrelated. It has noncash assets, which it sells to an unrelated purchaser for $100,000 in cash and $900,000 in installment...

-

Presented below are five independent situations. (a) Rachel Jackson, a college student looking for summer employment, opened a vegetable stand along a busy local highway. Each morning she buys...

-

Financial decisions often place heavier emphasis on one type of financial statement over the others. Consider each of the following hypothetical situations independently. (a) An investor is...

-

Special Delivery was started on May 1 with an investment of $45,000 cash. Following are the assets and liabilities of the company on May 31, 2012, and the revenues and expenses for the month of May,...

-

nformation pertaining to Noskey Corporation s sales revenue follows: November 2 0 2 1 ( Actual ) December 2 0 2 1 ( Budgeted ) January 2 0 2 2 ( Budgeted ) Cash sales $ 1 0 5 , 0 0 0 $ 1 1 5 , 0 0 0...

-

The management team of Netflix maintains a stable dividend using the Lintner model: Dt+1 = Dt + EPS Target Payout Where Dt (Dt+1) = dividend in the current period t (the next period t + 1) EPSt =...

-

#1 #2 hapter 50 10 D Werences lav Help Required information [The following information applies to the questions displayed below) Archer Company is a wholesaler of custom-built air-conditioning units...

Study smarter with the SolutionInn App