Companies that operate in different industries may have very different financial ratio values. These differences may grow

Question:

Companies that operate in different industries may have very different financial ratio values. These differences may grow even wider when we compare companies located in different countries.

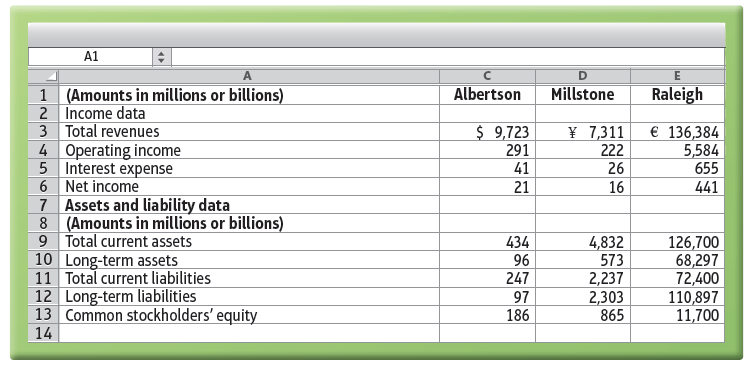

Compare three fictitious companies (Albertson, Millstone, and Raleigh) by calculating the following ratios: current ratio, debt ratio, leverage ratio, and times-interest-earned ratio. Use year-end figures in place of averages where needed for calculating the ratios in this exercise.

Based on your computed ratios, which company looks the least risky?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Financial Accounting

ISBN: 978-0134725987

12th edition

Authors: C. William Thomas, Wendy M. Tietz, Walter T. Harrison Jr.

Question Posted: