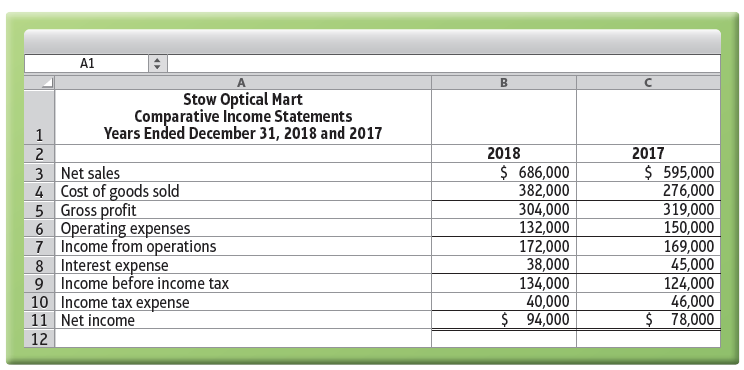

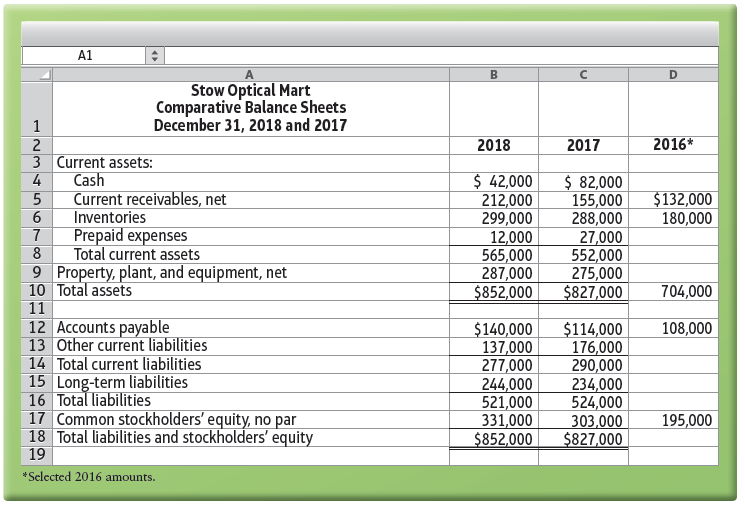

Comparative financial statement data of Stow Optical Mart follow: Other information: 1. Market price of Stow Optical

Question:

Comparative financial statement data of Stow Optical Mart follow:

Other information:

1. Market price of Stow Optical Mart common stock: $122.91 at December 31, 2018, and $165.75 at December 31, 2017

2. Common shares outstanding: 13,000 during 2018 and 8,000 during 2017

3. All sales on credit

4. Cash dividends paid per share: $2.75 per share in 2018 and $4.00 in 2017

Requirements

1. Calculate the following ratios for 2018 and 2017:

a. Current ratio

b. Quick (acid-test) ratio

c. Receivables turnover and days’ sales outstanding (DSO)—round to the nearest whole day

d. Inventory turnover and days’ inventory outstanding (DIO)—round to the nearest whole day

e. Accounts payable turnover and days’ payable outstanding (DPO)–use cost of goods sold

in the turnover ratio and round DPO to the nearest whole day

f. Cash conversion cycle (in days)

g. Times-interest-earned ratio

h. Return on assets—use DuPont Analysis

i. Return on common stockholders’ equity—use DuPont Analysis

j. Earnings per share of common stock

k. Price-earnings ratio

2. Decide whether (a) Stow Optical Mart’s financial position improved or deteriorated during 2018 and (b) whether the investment attractiveness of the company’s common stock appears to have increased or decreased from 2017 to 2018.

3. How will what you learned in this problem help you evaluate an investment?

Cash Conversion CycleCash conversion cycle measures the total time a business takes to convert its cash on hand to produce, pay its suppliers, sell to its customers and collect cash from its customers. The process starts with purchasing of raw materials from suppliers,...

Step by Step Answer:

Financial Accounting

ISBN: 978-0134725987

12th edition

Authors: C. William Thomas, Wendy M. Tietz, Walter T. Harrison Jr.