D.S. Enterprises executed the following transactions: Record these transactions in subsidiary books. Post them to ledger accounts

Question:

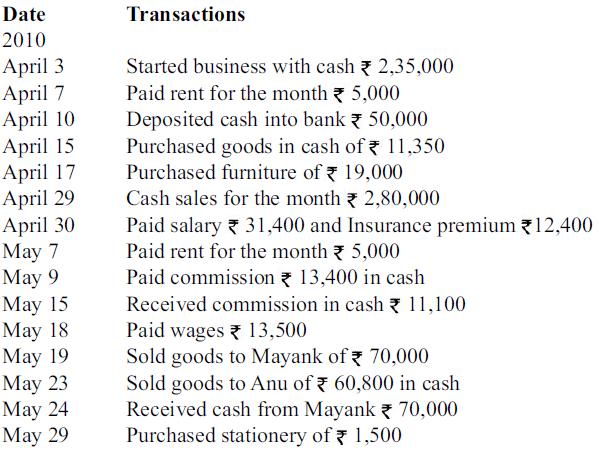

D.S. Enterprises executed the following transactions:

Record these transactions in subsidiary books. Post them to ledger accounts and prepare trial balance.

Transcribed Image Text:

Date 2010 April 3 April 7 April 10 April 15 April 17 April 29 April 30 May 7 May 9 May 15 May 18 May 19 May 23 May 24 May 29 Transactions Started business with cash 2,35,000 Paid rent for the month 5,000 Deposited cash into bank 50,000 Purchased goods in cash of 11,350 Purchased furniture of 19,000 Cash sales for the month 2,80,000 Paid salary 31,400 and Insurance premium 12,400 Paid rent for the month 5,000 Paid commission 13,400 in cash Received commission in cash 11,100 Paid wages 13,500 Sold goods to Mayank of 70,000 Sold goods to Anu of ₹ 60,800 in cash Received cash from Mayank 70,000 Purchased stationery of 1,500

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (1 review)

Total...View the full answer

Answered By

Nyron Beeput

I am an active educator and professional tutor with substantial experience in Biology and General Science. The past two years I have been tutoring online intensively with high school and college students. I have been teaching for four years and this experience has helped me to hone skills such as patience, dedication and flexibility. I work at the pace of my students and ensure that they understand.

My method of using real life examples that my students can relate to has helped them grasp concepts more readily. I also help students learn how to apply their knowledge and they appreciate that very much.

4.00+

1+ Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

P.P. Enterprises executed the following transactions: Record these transactions in subsidiary books. Post them to ledger accounts and prepare trial balance. Date 2010 June 1 June 3 June 4 June 7 June...

-

General Ledger (GL) Assignments expose students to general ledger software similar to that in practice. GL is part of Connect, and GL assignments are auto-gradable and have algorithmic options. For...

-

On April 1, Jiro Nozomi created a new travel agency, Adventure Travel. The following transactions occurred during the companys first month. April 2 Nozomi invested $46,000 cash and computer equipment...

-

The English publisher of a book called Cambridge gave a New York publisher permission to sell that book any place in the world except in England. The New York publisher made several bulk sales of the...

-

Par Corporation acquired an 80 percent interest in Sin Corporation on January 1, 2011, for $108,000 cash, when Sin's capital stock was $100,000 and retained earnings were $10,000. The difference...

-

In this problem, we continue the accounting for Fitness Equipment Doctor, Inc., from Chapter 3. On June 1, Fitness Equipment Doctor, Inc., expanded its business and began selling and installing gym...

-

Forecasting movie revenues with Twitter. Refer to the IEEE International Conference on Web Intelligence and Intelligent Agent Technology (2010) study on using the volume of chatter on Twitter.com to...

-

A gold-mining firm is concerned about short-term volatility in its revenues. Gold currently sells for $300 an ounce, but the price is extremely volatile and could fall as low as $280 or rise as high...

-

Northwood Company manufactures basketballs. The company has a ball that sells for $25. At present, the ball is manufactured in a small plant that relies heavily on direct labor workers. Thus,...

-

N.D. Enterprises executed the following transactions: Date 2010 April, 01 April, 02 April, 10 April, 11 April, 15 April, 17 April, 18 Transactions Cash in hand 1,70,500 and Bank balance 85,000 Paid...

-

M/s Sunder Enterprise executed the following transactions. Record these in the sales return book. Date 21/5/10 26/5/10 01/6/10 Invoice No. 131 133 142 Transaction Goods of value Goods of value Goods...

-

Should goodwill arising from an equity investment of more than 20 percent be recorded separately on the books of the investor? Explain.

-

Archer Contracting repaved 50 miles of two-lane county roadway with a crew of six employees. This crew worked 8 days and used \($7,000\) worth of paving material. Nearby, Bronson Construction repaved...

-

An insurance company has the following profitability analysis of its services: The fixed costs are distributed equally among the services and are not avoidable if one of the services is dropped. What...

-

The Scantron Company makes bar-code scanners for major supermarkets. The sales staff estimates that the company will sell 500 units next year for 10,000 each. The production manager estimates that...

-

Determine the following: a. The stockholders equity of a company that has assets of \(\$ 625,000\) and liabilities of \(\$ 310,000\). b. The retained earnings of a company that has assets of \(\$...

-

You are the manager of internal audit for Do-It-All, Ltd., a large, diversified, decentralized manufacturing company. Over the past two years, the information systems function in Do-It-All has...

-

Which type of endorsement is most appropriate for a business to use?

-

In 1995 Miguel purchased a home for $130,000. In 2000 he sold it for $170,000 and immediately purchased another one for $180,000, which he sold in 2007 for $235,000. How much taxable capital gain, if...

-

The board of directors is considering a stock split or a stock dividend. They understand that total stockholders equity will remain the same under either action. However, they are not sure of the...

-

(a) What is the purpose of a retained earnings restriction? (b) Identify the possible causes of retained earnings restrictions.

-

Fredo Inc.s common stock has a par value of $1 and a current market value of $15. Explain why these amounts are different.

-

Required information [The following information applies to the questions displayed below.] Dain's Diamond Bit Drilling purchased the following assets this year. Asset Drill bits (5-year) Drill bits...

-

Which of the following partnership items are not included in the self-employment income calculation? Ordinary income. Section 179 expense. Guaranteed payments. Gain on the sale of partnership...

-

Phantom Consulting Inc. is a small computer consulting business. The company is organized as a corporation and provides consulting services, computer system installations, and custom program...

Study smarter with the SolutionInn App