Eddies Convenience Stores income statement for the year ended December 31, 2017, and its balance sheet as

Question:

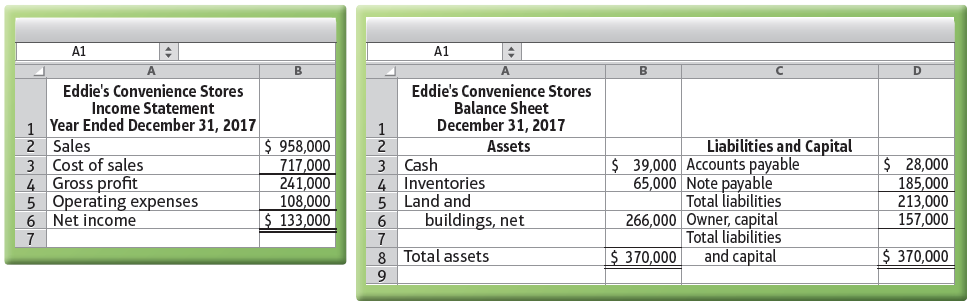

Eddie’s Convenience Stores’ income statement for the year ended December 31, 2017, and its balance sheet as of December 31, 2017, are as follows:

The business is organized as a proprietorship, so it pays no corporate income tax. The owner is budgeting for 2018 and expects sales and cost of goods sold to increase by 9%. To meet customer demand, ending inventory will need to be $84,000 at December 31, 2018. The owner hopes to earn a net income of $156,000 next year.

Requirements

1. One of the most important decisions a manager makes is the amount of inventory to purchase. Show how to determine the amount of inventory to purchase in 2018.

2. Prepare the store’s budgeted income statement for 2018 to reach the target net income of $156,000. To reach this goal, operating expenses must decrease by $1,310.

Ending InventoryThe ending inventory is the amount of inventory that a business is required to present on its balance sheet. It can be calculated using the ending inventory formula Ending Inventory Formula =...

Step by Step Answer:

Financial Accounting

ISBN: 978-0134725987

12th edition

Authors: C. William Thomas, Wendy M. Tietz, Walter T. Harrison Jr.