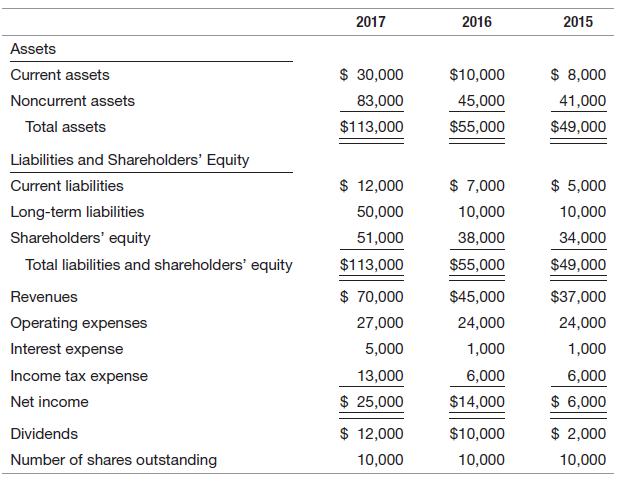

Question: Edgemont Repairs began operations on January 1, 2015. The 2015, 2016, and 2017 financial statements follow: On January 1, 2017, the company expanded operations by

On January 1, 2017, the company expanded operations by taking out a $40,000 long-term loan at a 10 percent annual interest rate.

On January 1, 2017, the company expanded operations by taking out a $40,000 long-term loan at a 10 percent annual interest rate.

REQUIRED:

a. Compute return on equity, return on assets, common equity leverage, capital structure leverage, profit margin, and asset turnover.

b. On January 1, 2017, the company€™s common stock was selling for $20 per share. Assume that Edgemont issued 2,000 shares of stock, instead of borrowing the $40,000, to raise the cash needed to pay for the January 1 expansion. Recompute the ratios in (a) for 2017. Ignore any tax effects.

c. Should the company have issued the equity instead of borrowing the funds? Explain.

2017 2016 2015 Assets $ 30,000 $ 8,000 $10,000 Current assets 83,000 45,000 41,000 Noncurrent assets $113,000 $55,000 $49,000 Total assets Liabilities and Shareholders' Equity $ 12,000 $ 7,000 $ 5,000 Current liabilities Long-term liabilities 50,000 10,000 10,000 34,000 Shareholders' equity 51,000 38,000 Total liabilities and shareholders' equity $113,000 $55,000 $49,000 $ 70,000 $45,000 $37,000 Revenues 27,000 Operating expenses 24,000 24,000 Interest expense 5,000 1,000 1,000 Income tax expense 13,000 6,000 6,000 $ 25,000 $ 6,000 $14,000 Net income $ 12,000 $ 2,000 $10,000 Dividends Number of shares outstanding 10,000 10,000 10,000

Step by Step Solution

3.49 Rating (162 Votes )

There are 3 Steps involved in it

a Return on Equity Net Income Average Shareholders Equity 2016 14000 34000 38000 2 389 2017 25000 38000 51000 2 562 Return on Assets Net Income Intere... View full answer

Get step-by-step solutions from verified subject matter experts